Subscribe & Follow

Advertise your job vacancies

Jobs

- Project Manager George

- Wills Sales Consultant Tshwane

- Commercial Insurance Sales Consultant Tshwane

- Team Leader: Dealer Sales Springs

- Risk Analyst - Financial Risk Management / Insurance Remote Location

- Insurance Sales Consultant George

- Motor Insurance Claims Consultant George

- RD and Retentions Consultant - Business Direct George

- Commercial Insurance Face-to-Face Specialist George

- Commercial Insurance Face-to-Face Specialist Cape Town

Long-term insurance complaints rose during second wave

The second wave of the Covid-19 virus at the end of 2020 drove up complaints to the long-term insurance ombud in the early part of 2021.

"We experienced a 48% increase in complaints in the first half of 2021 compared to the same period in 2020,” says Denise Gabriels, deputy ombudsman for long-term insurance.

Denise Gabriels, deputy ombud, long-term insurance

“Our staff were under pressure to keep up with the increased workflow under difficult conditions. In addition, because we are still not fully back in the office, as are insurers, there were some constraints in the complaints handling process.

“Although we obviously cannot predict what will happen for the rest of the year, the third wave of the Covid-19 virus is likely to have an impact on the number of complaints, which means that the high numbers may well continue,” she says.

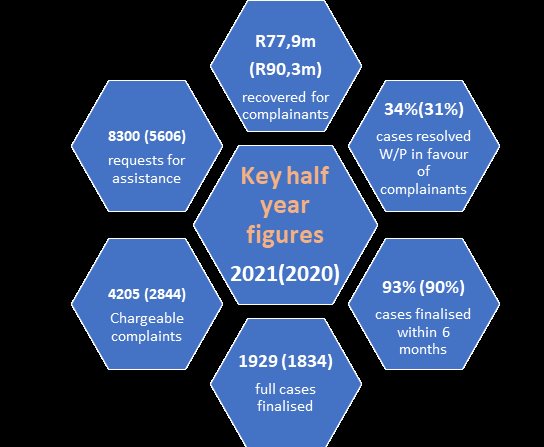

There were 8,300 requests for assistance in the first half of 2021 compared to 5,606 during the same period last year. There were 4,205 chargeable complaints (2,844 in 2020). A total of 1,929 cases were finalised (1,834 in 2020). 93% cases were finalised within six months (90%). The ombud's office recovered R77.9m for complainants.

Second wave deaths

Gabriels says the increased deaths during the second wave of Covid-19 led to the rise in complaints relating to funeral claims. Some funeral insurers experienced a substantial increase in claims during the December/January holiday period when staff members were on leave. This resulted in instances of poor claims handling and delays.

Complaints in the lapsing category were higher in 2021 than in 2020 as policyholders struggled to pay premiums under very difficult economic circumstances.

Poor service

A surprising phenomenon is that of the complaints finalised, the percentage of the claims declined category had reduced (44.95% in 2021 and 50.66% in 2020). Many of the complaints in the poor service category (58.2%) related to claims, where the insurer had not declined the claim, but the complaint was about the claims process which was often delayed.

Gabriels says 74% of the chargeable complaints, 3,126 complaints received in 2021, were transfers. These were complaints transferred by the ombud to insurers to try and resolve directly with the complainants.

Related

Complainants get R386m back in insurance payouts 1 Jul 2024 #BizTrends2024: Legal complaints in South African advertising will stay unique and conservative 9 Jan 2024 Office of the Tax Ombud celebrates 10 years of excellence 2 Oct 2023 Insurance ombuds are future fit to tackle post-Covid era 24 May 2023