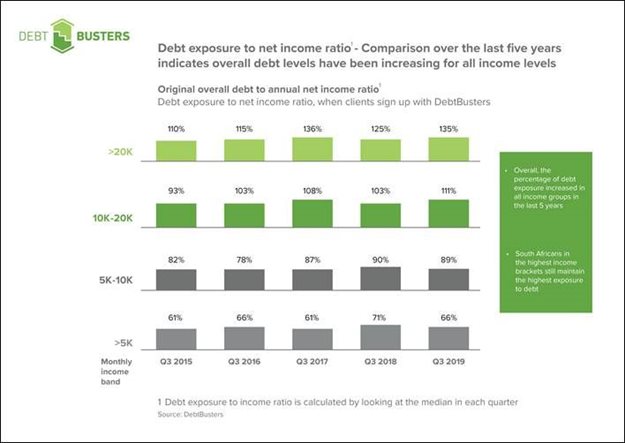

The report found that at 117%, the ratio of debt to net income amongst DebtBusters’ clients in Q3 2019 is the highest it has been during the last four years. For some income levels, the debt-to-income ratio is as high as 135%. Just last year, the same ratio was 109%.

“The debt-to-income ratio has gone up massively over the last few years and this is particularly concerning ahead of the festive season, when we know people are under the pressure to spend more,” says Benay Sager, DebtBusters’ chief operating officer.

More evidence that consumers’ appetite for borrowing has intensified, despite the straitened economy, is that they are becoming over-indebted faster. This is borne out by the fact that they have significantly fewer credit arrangements than in previous years when they apply for debt counselling – 8.4 in Q3 2015 versus just 6.4 in Q3 2019. This is not as a result of declining demand, but because they sooner reach the point where another loan is not the answer.

But Sager says the silver lining is that South Africa’s debt counselling system is working. The number of debt clearance certificates issued to DebtBusters’ clients increased by 69% per year between 2015 and 2019 - almost a tenfold increase in a four-year span. This year alone it has granted close to 5,000 clearance certificates.

“This means that more people are seeking help and then making the effort to settle their debts and become debt free. Debt counselling is helping thousands of South Africans get a fresh start in life."