Both globally and locally, coffee market players are increasingly expressing significant interest in sustainability, driven by ongoing concerns surrounding environmental issues and climate change. As a result of this focus, market players have been increasingly putting the 'green' back in coffee, by highlighting various sustainability efforts, including the introduction of recyclable or compostable packaging, as well as various other efforts that emphasise players' commitments to sustainability.

Insight Survey’s latest South African Coffee Industry Landscape Report 2023 carefully uncovers the global and local coffee market, based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African coffee industry environment and its future.

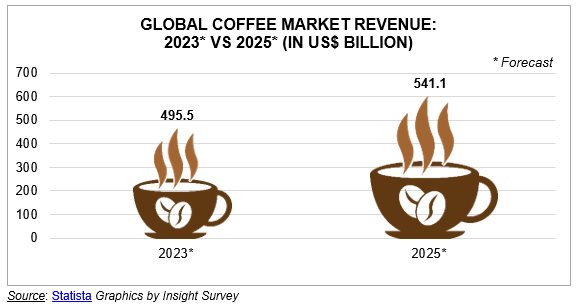

In 2023, the global coffee market is expected to reach an estimated value of approximately $495.5bn. Furthermore, the market is projected to increase at a compound annual growth rate (CAGR) of 4.5%, to reach a value of approximately $541.1bn by 2025, as illustrated in the graph below.

Locally, the South African coffee market experienced very strong growth in terms of off-trade retail value, at current 2022 prices, achieving a significant increase of 17.4% year-on-year, relative to 2021. This increase is expected to continue, with the market forecast to grow at a CAGR of 13.6% between 2023 and 2027.

As coffee continues to gain in popularity locally and across the globe, industry players have launched various initiatives to address ongoing environmental issues, and to meet intensifying consumer expectations in terms of sustainability. For example, in the global market, several coffee players are launching new coffee capsule products that utilise recyclable and environmentally friendly packaging. This includes Rokit Health and CafePod, which both recently launched 100% recyclable pods in the United Kingdom (UK), as well as Chamberlain Coffee, which introduced a new line of commercially compostable coffee pods, made up of patented plant-based materials.

Moreover, in response to ongoing global sustainability concerns surrounding coffee production and supply, lab-grown coffee products are trending in the global market, with players such as Stem, VTT Technical Research Centre, and CULT Food Science introducing new lab-grown coffee products as sustainably produced coffee options.

This focus on sustainability is also strongly notable in the South African coffee market, with local players focusing on eco-friendly packaging and highlighting their efforts towards a ‘green’ future. Specifically, in terms of packaging, sustainable coffee pods and capsules, which reduce or remove the use of plastic, have begun trending in the local market, in line with heightened consumer and brand awareness of ongoing environmental and sustainability issues.

For example, L’Or recently launched a new aluminium capsule, made from 100% recyclable material, which is designed to be used with Nespresso Original coffee machines. Cafféluxe has also made strides in eco-friendly packaging, launching the Cafféluxe ReNu Cleaning Capsule, which is indicated to be biodegradable, as well as its new limited-edition aluminium premium Coffee Capsule range that features sustainable aluminium casing.

Similarly, Lavazza introduced a brand-new range of ‘Coffee Icons’ capsules, which are all encased in aluminium, in support of the company’s focus on sustainability. Furthermore, Nestlé launched a new capsule range, namely ‘Starbucks At Home by Nespresso’ capsules, which is made from 80% recycled aluminium, and forms part of the company’s ambition to make 100% of its packaging recyclable and reusable by 2025.

In terms of other packaging efforts in this area, SEAM Coffee has recently partnered with Nampak to successfully develop a South African-made range of coffee packaging, which is both recyclable and has a low environmental impact. This packaging range will soon be available for sale in the country.

Nespresso South Africa also highlighted its commitment to sustainability with the introduction of a new retail environment space, at its flagship store in Sandton City. This new store features tabletops made from used coffee grounds, with wood sourced from reforestation programmes, amongst several other environmentally focused features, all of which aim to minimise waste and create a design that is ‘restorative by nature’.

The South African Coffee Industry Landscape Report 2023 provides a dynamic synthesis of industry research, examining the local and global coffee industry from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as a manufacturer and distributor overview, retail and pricing analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (production, consumption, trade, pricing) of the global and South African coffee industry?

- What are the latest global and South African coffee industry trends, innovation and technology, drivers, and challenges?

- What are the South African coffee market size value and volume trends (2017–2022) and forecasts (2023–2027), as well as channel distribution?

- Which are the key manufacturers, distributors, roasters, and retail players in the South African coffee industry?

- What is the latest company news for key players in terms of products, new launches, and marketing initiatives?

- What are the prices of popular coffee brands and products (instant, ground, beans, capsules and ready-to-drink) across South African retail outlets?

Please note that the 160-page full report is available for purchase for R40,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R17,500.00 (excluding VAT). For more information, please email az.oc.yevrusthgisni@ofni, call our Cape Town office on (021) 045-0202 or call our Johannesburg office on (010) 140- 5756.

For a full brochure: South African Coffee Industry Landscape Brochure 2023.