After the severe decline in media investment in 2020, the ad industry has been encouraged by a rapid recovery in 2021, with advertising being used as one of the levers to fuel recovery. As consumer behaviour continues to evolve, and we emerge into a new media landscape, brands need to understand which consumer and marketer attitudes have changed, and which have stayed the same. Which media brands have retained their appeal, and which have grown stronger?

Stacy Saggers, Kantar 26 May 2021

Media Reactions provides a comprehensive view of the global media landscape. Just launched, the 2021 edition is informed by the opinions of over 14,500 consumers covering over 290 brands in 23 markets and 900 senior marketers around the world to help brands navigate the new media landscape. It offers essential guidance for campaign planning with a ranking of media channels and brands and detailed insights into the channels and platforms consumers and marketers prefer.

Top-ranking media channels

While the pandemic accelerated digital growth in every aspect of life, we’ve seen robustness in consumers’ preference for offline advertising, and some strong local news brands. Consumers continue to be more positive about cinema ads, sponsored events, magazine ads and point of sale (POS).

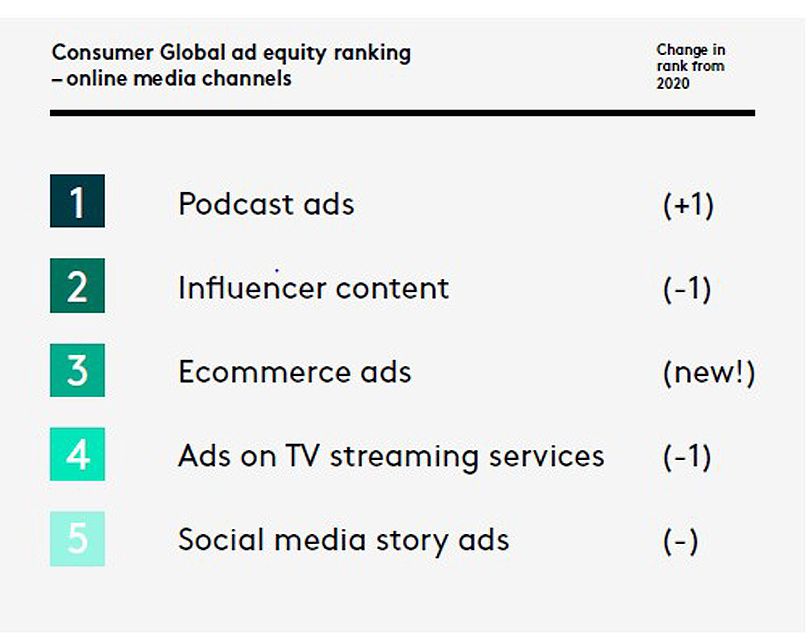

Podcast ads have risen in popularity amongst consumers since 2020. Positioned now at number 11 in the overall ad equity ranking, they have overtaken influencer content as the preferred digital ad medium.

Podcast ads are perceived as better quality and more relevant than they were in 2020, but also more repetitive, unsurprising given the increase in ad spend on the platform.

Our data shows that campaigns are seven times more impactful among a receptive audience, so marketers need to ensure their strategies respect these consumer preferences.

TikTok tops the ad equity chart again

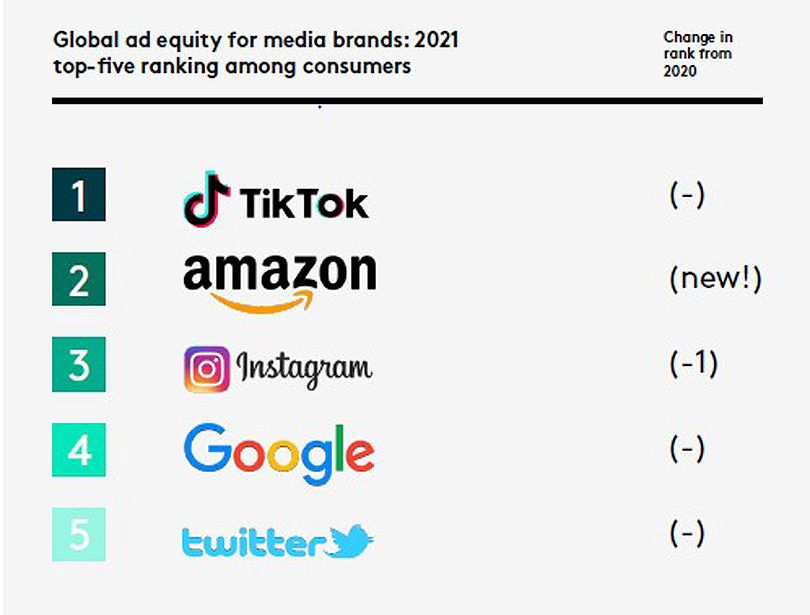

TikTok has done an impressive job retaining its differentiated advertising proposition with consumers – even as its user base has almost doubled over the past year.

Across branded digital platforms, TikTok remains top of the global ad equity rankings. Although only ranked as the number one platform in one market, Taiwan, TikTok is the leading global digital platform in the important US market and is the first or second-ranked digital platform in nine of the 22 markets we measured it in.

The inclusion of commerce platforms in this year’s ranking illustrates their increasing importance across the digital advertising landscape. Amazon ranks second globally among consumers, topping the list in four markets. Together with regional ecommerce giant Mercado Libre, which leads in Argentina, Amazon’s success showcases why e-commerce has entered the online media channel ad equity rankings in third place.

We also saw the re-emergence of retail as a critical ad platform, both online and physically. Advertising strategies that seamlessly align with omnichannel retail strategies provide a great opportunity for marketers to deliver more popular campaigns.

The three media dilemmas

As well as detailed insights into the evolving media landscape, this year’s study addresses three strategic media dilemmas.

1. The digital dilemma

How can you maximise consumer engagement and trust in an increasingly digital world?

Despite the explosion of digital media consumption and spend, as we see in the media channel ranking, consumers are still generally less positive about digital ads. This means that the risk of increasing irritation will rise unless marketers select the best digital channels and formats. While marketers continue to back digital platforms, the advent of a cookieless world has increased their uncertainty. Understanding the current digital landscape is essential to maximise consumer engagement in an increasingly digital world.

There should no longer be a divide between online and offline channels. A holistic approach to media is necessary as digital is more integrated into consumers’ day-to-day lives and more channels become digitised and opportunities to use data abound.

2. The glocal dilemma

How do you balance the benefits of the scale of global media platforms with the promise of greater relevance from local media gems?

Media Reactions highlights the importance, and challenge, of market-specific media strategies. In 16 of the 23 markets surveyed the number one ranked brand was a local media brand or a localised version of global media brands. Ten of these 16 are news and magazine brands. This local success, together with differing attitudes to the ads on global digital media brands, makes balancing the benefits of scale of global media platforms with the promise of greater relevance from local media gems ever more important.

3. The innovator’s dilemma

How can media brands get the balance right between maintaining trust while driving innovation?

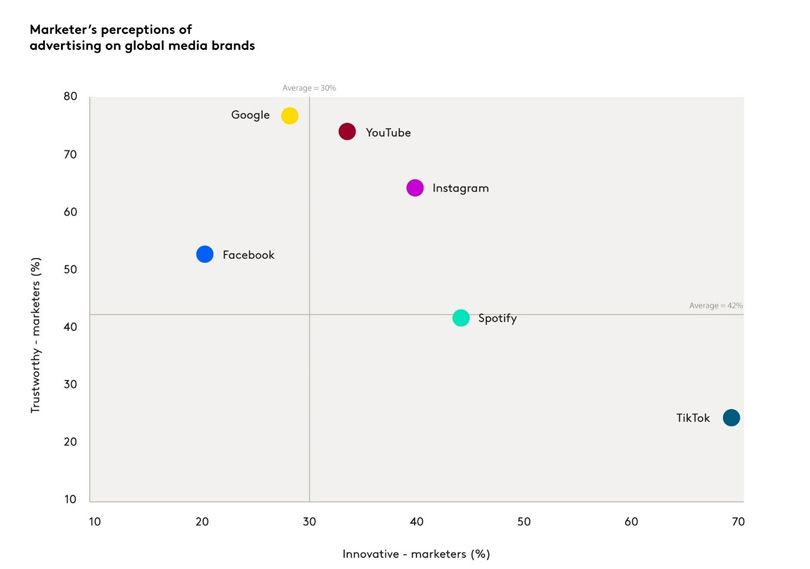

Media Reactions also highlights the challenge for brands to keep their media mix reflective of the latest consumer media preferences as well as their own values and brand positioning. Marketers favour channels and platforms they believe provide both trustowrthy and innovative advertising environments. Among the global brands, Instagram best manages this balancing act. YouTube, Google and Facebook are trusted platforms but are considered slightly less innovative.

TikTok is not yet trusted by marketers as much as the more established platforms, but it has made enormous improvements in the past year. It remains comfortably the most innovative place for ads, and trust has doubled, so many more marketers are now positive about placing ads on the platform.

The future outlook

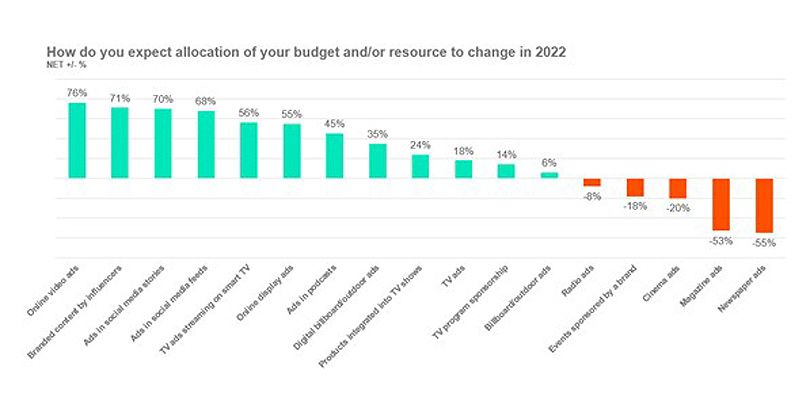

The marketers’ survey provides insights into media growth areas for 2022. The vast majority of global marketers’ plan to increase spend on their favoured ad formats: online video, influencer content and social media ads. Many will reduce spend on print ads. YouTube, Instagram and TikTok are the platforms set to benefit most.

To learn more about the global findings from Media Reactions 2021, as well as the winning brands in each market and much more, join our webinar on 9 September and download the complimentary booklet. Also get in touch to find out about the in-depth reports available for sale.

To find out more about the Media Reactions insights for South Africa, chat to: Monique Claassen, Head of Media & Digital, Insights Division, Kantar on moc.ratnak@nessaalc.euqinoM.

Also join the conversation on LinkedIn and Twitter to keep up to date with our comms, and sign up for our Inspiring Growth newsletter for a weekly round-up of our best insights.