An analysis of the South African fast food industry in 2019 showed that there was opportunity for the continued expansion of fast food outlets but that the market was beginning to saturate. A consequence of this is that there are fewer sites available for fast food outlets and those that are available, are generally for smaller outlets.

Now with the “new normal” of Covid-19, the market has been put into a tail-spin that will halt most fast food chains’ plans of rapid expansion, which has been the trend in past years.

By doing a proper network-based accessibility study, it is possible to holistically identify gaps in the fast food market for restaurants of different sizes. The reality is that these gaps are becoming smaller and consequently, provides opportunity for smaller operations like forecourts, drive-throughs, takeaway and curbside operations, as what is being proposed by Starbucks in the USA.

This transformation is being accelerated as a consequence of changes in consumer behaviour brought on by Covid-19.

Areas where strong opportunity remains for larger forms of fast food restaurants are in new residential and commercial developments and where new malls are being constructed. Many of the large new developments have stalled for various reasons and the development of new malls will be constrained by economic challenges and dwindling demand.

The development of centres with clusters of fast food restaurants is an opportunity for the expansion of the fast food industry, especially in emerging markets where the development of commercial centres and malls has been limited. This solves a major problem that the industry is facing and that is the lack of preferred sites (i.e. near malls) that attract enough customers for them to open a new restaurant.

Hierarchical fast food network development key to sustainability

The central place theory is key to the sustainable development of the retail sector in South Africa. The theory explains that there is a "central function” or economic hub (e.g. regional mall) that serves “central places” in a network (i.e. geographical places from where customers travel).

These economic hubs have a minimum travel time from which customers are willing or can afford to travel to reach them. There must also be enough customers with sufficient purchasing power to ensure the financial viability of the economic hub. By clustering fast food outlets (known as agglomeration) of different types and chains, creates a central function that allows the attracting of enough people from surrounding areas to enable the sustainability of the retail outlets.

The theory emphasises that these economic hubs generally form part of a hierarchy within a market area. For example, for every large shopping mall with its own distinct market area, there are several levels of smaller order shopping malls with their own market area.

The market areas of these lower-order shopping malls nest within the larger one (see adjacent diagram). This thinking is equally important to the development of fast food networks with restaurants of different sizes from the same and competing brands forming part of a hierarchy.

Of course, this design principle is not always followed in South Africa, resulting in significant cannibalisation, which places the entire retail network in an unbalanced state. To stabilise the situation, malls have to expand or change their retail mix to enable them to survive, while fast food outlets will show continuous negative growth or may have to close. This is not always in the best interest of an economy.

New fast food outlet types - part of a new normal

With a saturating market now constrained by economic and Covid-19 factors, transformation to the small forms of fast food outlets is becoming a reality. Another transformation is the opening of ghost or virtual kitchens that produce meals for online services and delivery to customers.

Miles Khubeka on Bruce Whitefield’s eNCA Taking Stock programme emphasised that the lack of good quality restaurant sites is one reason for developing “cloud’ kitchens. Another reason would be to reduce operational costs by rationalising the production process of multiple outlets, especially for delivery services.

Ghost or virtual kitchens, as they are alternatively known, have been at the forefront of innovation in the fast food industry in the USA for a while. In 2019 there was uncertainty as to whether virtual kitchens would be successful. However, the onset of Covid-19 has speeded up the process of transforming the fast food industry and allowed other fast food outlet types to make their presence in the USA and SA.

It is anticipated that with the transformation of the industry, some fast food chains will pause the development of new restaurants or curtail their restaurant growth plans. There will also be a rationalisation of their restaurant networks. Starbucks already indicated that they will be closing up to 400 outlets in the USA.

To do this requires a holistic approach that can only be provided effectively through accessibility modelling. Accessibility modelling looks at the entire restaurant network to see if there are gaps for expansion or to identify which restaurants are first in line to be closed.

Restaurants that have the lowest turnover or poor growth are not always the ones that should be transformed, relocated or closed. The situation is that there are often other restaurants in the same fast food chain that are dramatically cannibalising the restaurant’s market, causing its poor performance.

The poor performing restaurant may be in the best location to reach the target market considering the travel time and purchasing power of consumers. Therefore, it would be better to close the restaurants that are not optimally located and are cannibalising other restaurants in the network.

The fast food industry in SA has for some time been experiencing tough trading conditions and more so now during the Covid-19 lockdown. Brands such as Starbucks and Domino's of Taste Holdings; Steers, Debonairs and Wimpy of Famous Brands and more recently, the Spur Corporation that includes Spur Steak Ranches, Panarottis Pizza, John Dory's, Hussar Grill, RocoMamas, Spur Grill & Go and Casa Bella.

The question is: with the continued surge of the Covid-19 pandemic and the possible closure of many sit-down restaurants for months to come, how will these brands transform? Or will they have to start closing restaurants in their network?

Will Starbucks SA follow USA example?

Starbucks SA has for several years struggled, and in early 2019 had a drop in sales because of poor consumer spending, licensing expenses and a very constrained national economy. Commentators have identified the rollout of suitably sized outlets in the SA market as an issue, against a well-established competitor market lead by companies such as Vida e Caffè and Seattle Coffee as well as several independent coffee resellers.

A key strategy would be to reduce operating costs and at the same time identify niche markets that would make their coffee shops profitable. The latest happening is that Taste Holdings has sold its Starbucks license to a group of their independent directors.

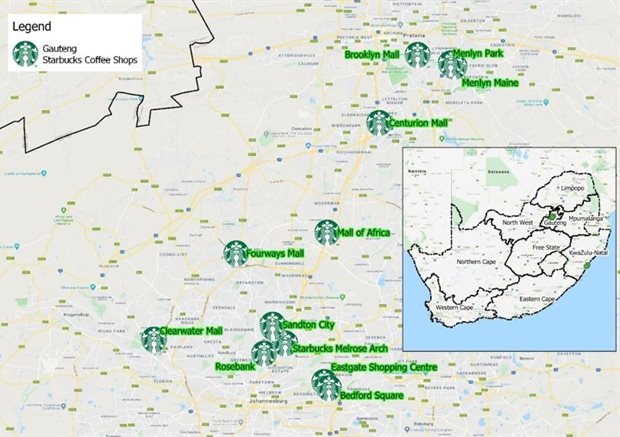

The new license holder was planning in 2019 to rapidly grow the number of Starbucks outlets towards the target of 200 coffee shops. Presently, they have only 16 coffee shops that are located in malls in the provinces of Gauteng and KwaZulu-Natal. In Gauteng, they have three coffee shops in Pretoria, four in Rosebank/Sandton, two in Centurion/Midrand, two in the West Rand and two in the Bedfordview area (see map below).

The coffee shops in KwaZulu-Natal are situated in Westville, Florida Road and Umhlanga. Surprisingly, there are no Starbucks in the Cape Peninsula and other metros in the country.

The development of Starbucks drive-through outlets in SA was mooted as an option more than a year ago. The onset of Covid-19 and Starbucks in the USA transforming, stopping expansion, relocating and closing coffee shops, signals a change in strategy that should be followed in the SA market. This would see Starbucks open optimally located smaller coffee shops similar to those in the USA market with lower operational costs.

A proper network strategy is needed to secure Starbucks locations across the country in prime sites so as to sustain their existing clientele. When the time is right post-Covid-19, Starbucks can re-examine the fast food environment and then evolve the brand further, opening coffee shops that allow the sustainable expansion of the brand under more profitable conditions.

This approach is not only applicable to Starbucks but many of the fast food chains in South Africa. Post Covid-19 will see movement back to sit-down restaurants, but this will be constrained by consumer sentiment, the economic impact of the pandemic as well as SA’s downgrade.

Consumer behaviour is going to be much more important to understand in the near future so that the fast food industry can keep an eye on how the dynamics of the market are changing. This will include having a more holistic understanding of the location of a chain’s restaurants and their trade areas.

Trade areas are defined by knowing where customers are coming from or understanding the minimum travel time and the number of customers needed in the target market to ensure the financial viability of a restaurant. Information on the socio-economic, fast food expenditure and purchasing behaviour of the population provide invaluable insights into viability of a fast food restaurant.

This analysis cannot be done in isolation as several other factors (such as competitors, traffic flows, accessibility, attraction points and projected turnover) play a role in determining whether a restaurant will make a profit. What is key is to follow the principles laid out in the central place theory and that is the establishment of a network of sustainable fast food outlets.

There is an Ethiopian proverb that says “when spider webs unite, they can tie up a lion” - intimating that when you have a network of well-located fast food restaurants of different types and sizes, you will have sufficient strength to develop a sustainable presence in the market and be able to weather most impacts that fast food brands will have to face in the immediate future.