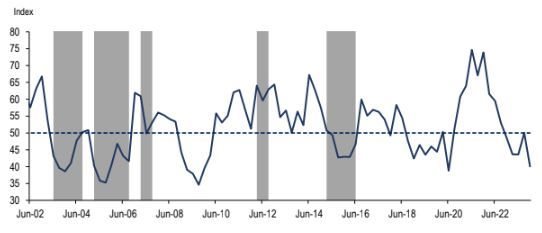

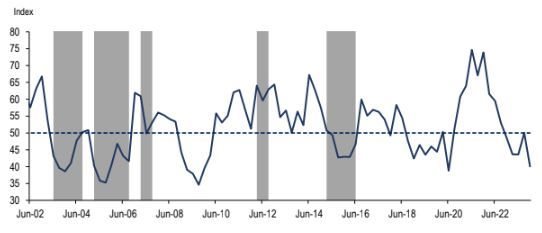

The Agbiz/IDC Agribusiness Confidence Index (ACI) deteriorated by 10 points to 40 in Q4 2023. This is its lowest level since Q2,2020, at the height of the Covid-19 pandemic hard lockdown restrictions.

Critically, the Q4 2023 reading is below the neutral 50-point mark, implying that South African agribusinesses are downbeat about business conditions in the country. This pessimism emanates from the numerous challenges facing the sector such as intensified delays and inefficiencies at the ports, deteriorating rail and road infrastructure, worsening municipal service delivery, increased geopolitical uncertainty and persistent episodes of load-shedding.

This survey was conducted between the last week of November and the first week of December, covering businesses operating in all agricultural subsectors across South Africa.

Figure 1: Agbiz/IDC Agribusiness Confidence Index

Source: Agbiz Research, South African Weather Service(Shaded areas indicate periods when rainfall across South Africa was below the average level of 500 millimetres.)

Discussion of the subindices

The ACI comprises ten subindices, and eight declined in Q4 2023. This excludes the debtor provision for bad debt and financing costs subindices, which are interpreted differently from other subindices. Here is the detailed view of the subindices.

• The turnover and the net operating income subindices are down by 7 and 12 points from Q3 to 67 and 47 in Q4 2023, respectively. This downbeat mood mirrors the prevailing concern that while El Niño could be mild, the agricultural output will likely be lower than the previous bumper season, weighing on incomes.

• The market share of the agribusiness subindex is down by 5 points from Q3 to 53. Except for the respondents in the summer crop regions, most held a generally unchanged view from the previous quarter. Still, this was overshadowed by the concerns about summer crops, thus causing the deterioration in market share sentiments.

• The employment subindex fell by 12 points from Q3 to 47. This is unsurprising in an environment with concerns about the sector's outlook. Still, the sentiment shows a stark disconnect from the recent robust jobs data in the sector. For example, in Q3 2023, about 956,000 people were employed in primary agriculture, up 10% y/y.

• The capital investments subindex dropped by 30 points from Q3 2023 to 43. This reflects the declining spending pattern on agricultural equipment and machinery we have observed over the past few months.

• Following a sharp decline in Q3 2023, the sub-index measuring the volume of export sentiment fell further by a point to 42 in Q4. This deterioration in sentiment signals the expected decline in export volumes this year from the robust levels of 2022, although the harvest is reasonably decent in all major crops and fruits. Moreover, the ongoing worries about underperforming ports also added to the prevailing pessimism.

• Unsurprisingly, the general economic conditions subindex is down by 16 points to 10 in Q4 2023. This mirrors the general macroeconomic underperformance of South Africa.

• While the worries of a potentially harsh El Niño have eased, and there is growing comfort that rainfall could continue into early next year with dryness starting to deepen around March, the general agricultural conditions subindex fell by 16 points to 40 in Q4 2023.

• The subindices of the debtor provision for bad debt and financing costs are interpreted differently from the abovementioned indices. A decline is viewed as a favourable development, while an uptick signals growing financial strain. In Q4 2023, the debtor provision for bad debt was down by 5 points to 37, which is a favourable development. Meanwhile, the financing costs indices increased by 7 points to 13, signalling that agricultural firms are still worried by the elevated interest rate in an industry where farm debt is hovering around R200bn.

While South Africa's agricultural sector had a generally good season this year, with gains illustrated by robust employment conditions and export volumes in the first three quarters, the outlook is worrying. The Q4 results indicate that more work is needed to improve the operational conditions in the farming and agribusiness sector.

The key constraining issues to South Africa's agricultural growth potential include weakening municipalities, deteriorating roads, rising crime, inefficient logistics, and persistent loadshedding. The government and private sector should collaboratively work to resolve these constraints to attract investments and boost long-term growth.