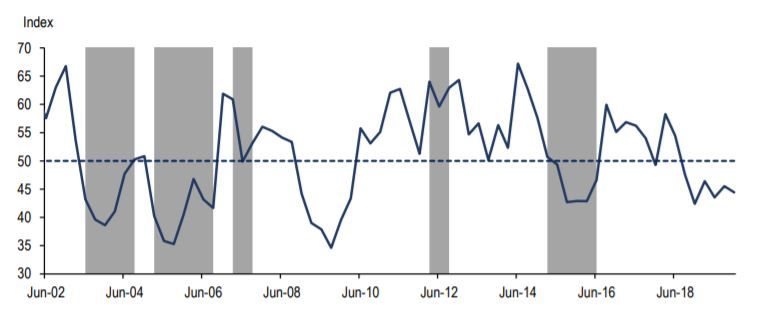

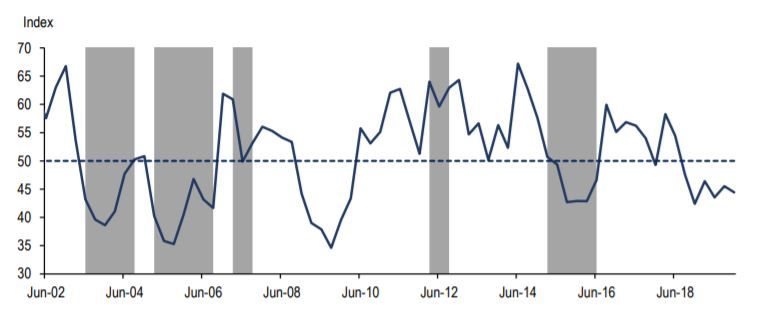

The Agbiz/IDC Agribusiness Confidence Index (ACI) fell slightly from 46 points in the third quarter to 44 in the last quarter of 2019. A level below the neutral 50-point mark implies that agribusinesses are still downbeat about business conditions in South Africa.

This has been the case over the past six quarters, which is the longest period the index has trended below 50 points since 2010. The survey was conducted in November and covers of agribusinesses operating in all agricultural subsectors across South Africa.

Figure 1: Agbiz/IDC Agribusiness Confidence Index

Source: Agbiz Research, South African Weather Service(Shaded areas indicate periods when rainfall across South Africa was below the average level of 500 millimetres)

The composite index comprises 10 subindices, most of which are still generally subdued, not only from the previous quarter, but compared to the long-term average levels since the index’s

inception in 2001. Six out of the 10 subindices that make up the composite index drove the decline in sentiment in the fourth quarter of 2019.

Discussion of the subindices

Subindices that underpinned a decline in confidence

The decline in the ACI was mainly underpinned by net operating income, employment, the volume of exports, economic conditions, general agricultural conditions and debtor provision for bad debt subindices.

• Confidence regarding net operating income of agribusiness fell by just one point from the third quarter of this year to 44 in the fourth quarter. The downbeat sentiment was largely amongst firms operating in field crop producing areas and also livestock.

This suggest the poor harvest in the 2018/19 summer crop production season and the 2019/20 winter crop production season have weighed negatively on sentiment about net operating income. In the case of livestock, reports of another foot-and-mouth disease (FMD) outbreak in the country have also weighed on sentiment as this affects the trading of livestock products and thereafter profitability of firms and farms.

• The employment sub-index of the survey deteriorated by five points from the third quarter to 53, which is still above the neutral 50-point mark. The subsector that was relatively pessimistic about employment conditions was the field crop sector, which can partly be explained by fears that the current drought could lead to reduced plantings in the 2019/20 season and thereafter activity on farms.

• The sub-index measuring the volume of exports fell from 50 points in the third quarter of the year to 39 in the fourth quarter. This is consistent with the aforementioned points that fears of drought could lead to poor crop production, which in turn would affect exports.

This is not only a matter of the 2019/20 production season but also the 2018/19 season where major grains harvest fell by double-digit levels from the previous season. In addition, fears that the new FMD outbreak could lead to another wide scale livestock products exports ban also weighed negatively on sentiments about exports.

• The perception regarding general economic conditions in the country fell by 15 points to 9, which is the lowest level since the second quarter of 2016. This goes to show that agribusinesses are not enthused about the economic outlook, and the recent GDP data for the third quarter of this year, which showed 0.6% quarter-on-quarter seasonally adjusted and annualised rate contraction, corroborates this sentiment.

• After recovering from 31 points in the second quarter to 42 in the third when there were still prospects of good summer rains in 2019 going into 2020, confidence regarding general agricultural conditions slipped back to 31 in the last quarter of the year.

This is mainly because of the drastic change in the weather outlook to prospects of drought in parts of South Africa, combined with the late start of summer rainfall which has affected negatively the summer crop planting schedule. Moreover, nearly all survey respondents expressed concern about the weather outlook and thereafter agricultural conditions in the country.

• The debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a favourable development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the fourth quarter of this year, the sentiment regarding the debtor provision for bad debt increased by 4 points to 34.

Subindices that showed an improvement in confidence

Sentiments regarding the turnover, market share of agribusinesses, capital investment and financing costs of agribusiness improved somewhat in the last quarter of 2019.

• Surprisingly, the turnover subindex confidence lifted from 56 in the third quarter to 75, which is the highest level since the first quarter of 2018. The financial institutions, input suppliers and also horticulture-focused firms that are part of the survey were the ones that expressed optimism in this particular subindex.

• The market share of agribusinesses subindex was at 62 points in the fourth quarter of 2019 from 58 in the previous quarter. The only firms that expressed positive sentiments on this point are the ones operating within the horticulture industry, while others maintained an unchanged view from the previous quarter.

• The capital investments confidence subindex remained flat from the third quarter at 50 points. Similar to the previous quarters, the consistent veiw that we continue to hear from agribusiness leaders is that the lack of clarity regarding land reform and water rights, and also biosecurity challenges and poor shipping ports' infrastructure remain an overhang that could constrain the potential expansion in fixed investments and thereafter growth in South Africa’s agriculture sector.

• As previously stated, the debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a favourable development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the fourth quarter of this year, the sentiment regarding the financing costs remained unchanged from the third quarter at 44 points, possibly reflecting the stable interest rate environment over the period.

Concluding remarks

The ACI has been at levels below the neutral 50-point mark for six consecutive quarters, which is the longest strek of sub-50 since 2010. This has been underpinned by both the unfavourable agricultural policy environment and also weather conditions. Unfortunately, both could persist going into 2020 and possibly result in further underperformance of South Africa’s agricultural economy.

While South Africa’s agricultural policy environment, specifically land reform and water regulations, remains unsatisfactory, the unfavourable weather conditions and biosecurity are pressing matters that could constrain agricultural economic fortunes.

The recession that South Africa’s agricultural economy finds itself in is caused by these very same factors, and we fear it might spill over to 2020, other things being equal.