Rising inequality is a global problem that has come from a lack of access to resources as well as markets for basic goods and services and for decent work. In the world today, 1.2 billion people live in poverty, with 70% directly dependent on natural resources for their livelihoods.

This is not new; we all know what the problems are, says Alastair Schorn, MD of Sustainability Consulting. The opening speaker at the Green Business Seminar, which formed part of Sustainability Week which took place in Pretoria last week, he points out that there is a direct contradiction between sustainable development goals and massive corporate profits.

"The world has stagnating economies, with structural deficits, institutionalised sovereign debt, bailouts that are too big, job losses and fluctuating commodity prices. The greatest market failure of the world is climate change."

He also says that our planet is full, but we are staring at increased consumption from developing countries. "Our current model is no longer fit for purpose and what is needed is a new set of rules for corporate citizens to operate under."

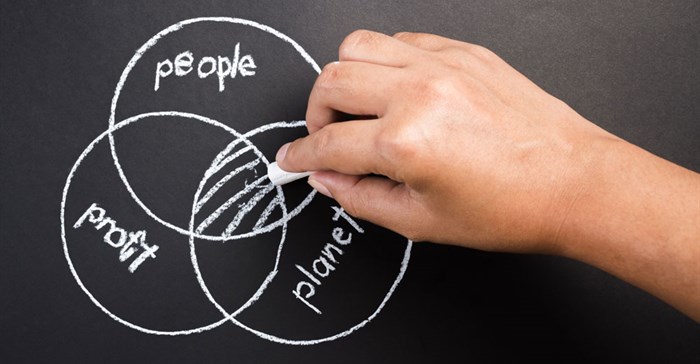

It is a fallacy that there has to be a trade-off between economic growth and environmental protection, he adds. You do not have to choose one or the other. What is needed is a fair and inclusive green economy.

He explains that this is when natural capital is managed with ecological boundaries. "It is the investing in people and greening of economic sectors and the growing of green sectors. It also includes influencing financial flows and investing in a common future, improving governance and measurement (that is redefining what progress is)."

Change is afoot

An example of a change in thinking is the financial sector. Following the financial crisis, a new thinking or a rethink of how we use humans and organisations crystallised in the financial sector. As a result, we are seeing some changes, but we are still far from where we want to be.

This is according to Corli le Roux, head of the Johannesburg Stock Exchange's (JSE) Socially Responsible Investment (SRI) Index. As a result of the crisis, the stakeholders are the new scorekeepers, job silos are crumbling, external reporting and transparency is under the spotlight and a holistic perspective is becoming more prevalent. "The value proposition for integrated sustainability is gaining traction as it is apparent that we are living in a fragile economy in dire need of the ability to sustain value creation."

The JSE is a central player in the local market but has global reach. Its sustainability initiatives are multifaceted. It takes a hybrid approach to create an enabling environment to influence change through conversation. Listed companies have to comply with regulatory framework, King III and mandatory governance. The JSE itself hosts an annual showcase for companies and investors where case studies are showcased and engagement and advocacy is put forward so that the sector can debate and learn between itself.

The JSE SRI Index is a pioneering initiative launched in 2004 and the first of its kind in an emerging market. It aims to encourage integrated risk management and is therefore both positive and aspirational. In the 10 years of the index, it has never had less than the top 40 companies on the index. It is dominated by the retail and property sector, and mid-cap to medium companies.

As a listed company in its own right, the JSE is highly dependent on energy as well as scarce skills. In the global context, the JSE is looking at the green bond space. The thinking in South Africa, however, is advanced. South Africa is progressive because of King III.

Building consensus

One of the biggest developments recently is the World Federation of Exchanges' Sustainability Working Group, of which JSE is currently vice chair and on which le Roux represents the JSE. The group works to build consensus on the purpose, practicality and materiality of ESG information (21 exchanges belong to it.).

She says 10 years ago very few of these global conversations existed, today the conversion is growing exponentially. But the real question is whether it will have an impact. Capital markets play an important role in economic development but there are many barriers to change.

So what is the meaning of true value and what value are you creating? This is a significant debate happening in the context of integrating reporting. Investors need to rethink that return is not only a financial return but also social and environment returns. Noises are happening and starting to come through into mainstream.

Investors and sustainability people need to start talking the same language and have a conversation to the benefit of what both are trying to do achieve.

Sustainability Week was held from 23-28 June 2015 at the CSIR Convention Centre. For more info, go to www.sustainabilityweek.co.za.