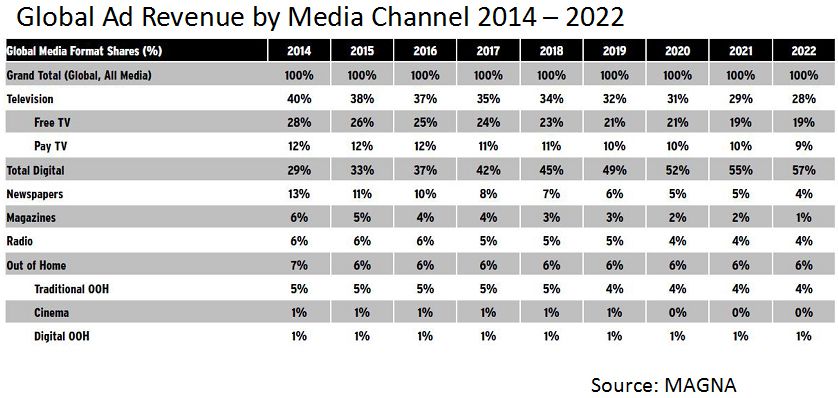

I recently reviewed some research conducted by MAGNA Intelligence, the well-respected US-based resource on advertising and media, which presented the historic and projected share of global advertising revenue by media channel, and it made for some very interesting reading.

The research confirmed the incredible growth of digital media worldwide and the subsequent pressure this growth has placed on most other traditional mediums.

Impact of digital

The results of the research suggested that digital media’s market share will grow from the 29% it enjoyed in 2014 to approximately 52% by next year, 2020, which is obviously not good news for traditional platforms.

Newspapers and magazines are predicted to continue their slide, falling from 19% in 2014 to just 7% by next year.

The report suggested that TV is performing slightly better and will decline ‘only’ 9%, when one compares the 2014 and 2020 numbers.

Of all the media platforms, it seems that out-of-home and radio have been more resilient in surviving the digital storm, with radio predicted to decline by just 2% and out-of-home 1% over the same period. Interestingly, cinema, which is classified as out-of-home, is predicted to be extinct by 2020.

If one drills down a bit further, the MAGNA numbers show that traditional out-of-home will have declined by 1% by next year, whilst digital out-of-home will retain its market share of 1% of advertising revenue over the same period.

Contributing factors

The take-out from this, for me, is that whilst other media are losing out to digital, out-of-home market share has remained largely stable over the last five years and resilient in the face of the threat of digital.

But, why?

My 21 years in the out-of-home industry have given me some insight into why I believe out-of-home has retained its share and will continue to grow faster than TV, radio and print, both in South Africa and across the African continent:

- Firstly, out-of-home is a geo-targeted medium by nature and wastage is therefore minimised, which contributes to both the effectiveness and affordability of the medium. Compared with TV and radio, this is a huge selling point for out-of-home.

- The continued growth of digital placed based out-of-home networks are offering very clearly segmented audiences in captive environments with loads of dwell time and frequency on offer.

- Out-of-home has largely remained unfragmented and continues to offer advertisers a very economically active mass audience. Research confirms that consumers are spending more and more time out of home and this has and will increase the effective reach of out-of-home. Unlike the fragmentation of most other mediums, Out-of-home has remained stable.

- Global populations are increasingly urbanising and out-of-home is becoming more and more integrated as part of the urban landscape, along with now being equipped with cutting-edge technology and digital capability.

- Better and more accurate out-of-home measurement data like the OMC is now available, making accurate ‘intermedia’ comparisons possible and contributing to increased investment into out-of-home.

- Digital out-of-home has brought renewed interest in out-of-home and improved its capability, with new features such as day-part targeting, instant update capability and better reporting increasing the efficacy of out-of-home and making a case for greater investment in the channel.

- Out-of-home has also evolved into a very effective “last yard” influencer medium and some digital platforms are now positioned very close to or at the point of purchase, making them invaluable to advertisers. These platforms are also now linked to electronic point of sale (EPOS) data and are used very effectively to influence purchase behaviour and drive price and product at points of purchase.

Conclusion

Most other traditional media channels have largely remained stagnant and not evolved as the consumer and media landscapes have changed.

Not out-of-home, and this is why it has remained relevant and successful.

With new and cheaper technology, greater urbanisation, and a new generation of “on demand” consumers, the foundations are in place for out-of-home to continue to grow, both in South Africa and across the African continent.