With prime residential prices in Dubai accelerating 44.2% in 2022, it has maintained its position at the top of Knight Frank's Prime International Residential Index (PIRI 100), according to the latest Wealth Report.

Closer to home, Cape Town, following a tough year coming out of Covid, has made its way back up the PIRI 100, moving up 63 places in the last 12 months from 94th to 31st.

“Having slipped due to feeling the effects of the pandemic on a third-world country, it has again proved incredibly resilient and is once again attracting both South Africans from other territories as well as foreign buyers looking for second homes and to enjoy the beauty, lifestyle and value that the city has to offer," said Nick Gaertner, director and COO of Knight Frank South Africa.

"While broader South Africa continues to struggle with poor governance, strong leadership in the City of Cape Town has managed to steadily separate it from other regions within the country and develop itself into a growlingly desirable destination globally.”

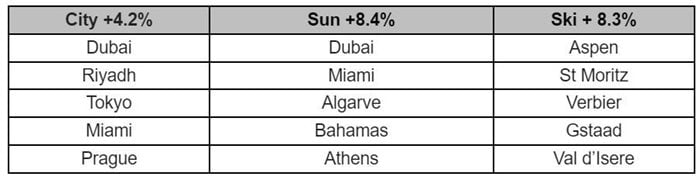

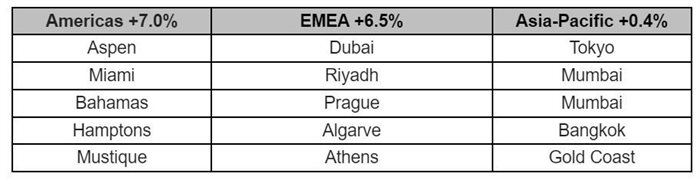

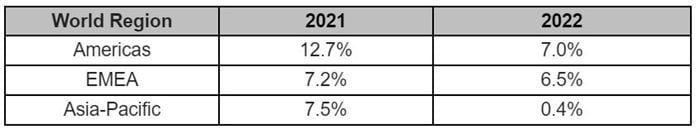

Of the 100 markets tracked in PIRI, which analyses prime price performance in 100 city, sun and ski locations globally, 85 recorded positive or flat price growth in 2022. The Americas (7%) narrowly pipped Europe, the Middle East and Africa (6.5%) to the title of the top-performing region, with Asia-Pacific trailing on 0.4%.

Resorts outperformed

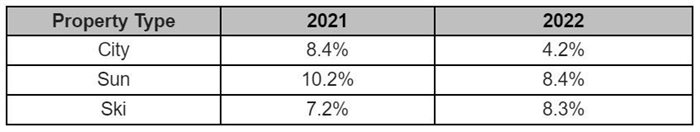

Coastal and rural locations in sunnier climes saw average price growth of 8.4%, marginally ahead of ski resorts which were up 8.3%, on average, eclipsing their 2021 record. Weaker price growth was seen in key city markets tracked with prices rising on average half as much as in coastal and rural locations (4.2%).

Said Kate Everett-Allen, partner, residential research at Knight Frank: “Last year we referred to 2021 as 'an anomaly', a year characterised by stellar price growth as markets reopened post-Covid-19 and revenge spending took hold. Off the back of such a boom, you might be forgiven for thinking 2022 would see a return to business as usual. Far from it. Omit 2021, and 2022 posted the highest level of prime price growth on an annual basis (5.2%) since the global financial crisis.

“Wealth preservation, safe-haven capital flight and supply constraints played their part in driving prime price growth, but it was the post-pandemic surge that continued to push prices higher. For the world’s wealthy, this increased their appetite to buy, with 17% of UHNWIs (ultra-high-net-worth individuals) adding to their portfolios in 2022.”

Price growth to slow in 2023

Liam Bailey, Knight Frank’s global head of research, said, “The post-Covid boom in global housing markets provided the impetus for even more price growth over the past 12 months, but even luxury markets aren’t immune from the biggest pivot in interest rates in history. Price growth will slow in 2023, but markets will deflate rather than collapse – this isn’t 2008.”

Slower price growth is not a uniform picture, as Knight Frank’s analysis reveals. Some prime markets are feeling the effects of the changing macroeconomic landscape more than others. Fifteen saw prime prices decline in 2022, up from seven in 2021. Almost half of those falling in 2022 were in Asia-Pacific.

Markets registering the strongest price growth during the pandemic are amongst the biggest fallers: Wellington (-24%), Auckland (-19%), Stockholm (-8%), Vancouver (-7%), and Seoul (-5%). Cities are feeling the brunt more than resorts.

Nonetheless, the transition from a sellers’ to a buyers’ market is well under way, though limited prime stock in several major cities exacerbated by the pandemic is putting a floor under luxury prices. With several economies potentially past their inflation peak – and hence nearing the end of their monetary tightening phase – all eyes will turn to the resilience of labour markets. As yet, forced sellers have been notable by their absence.

Knight Frank’s Prime International Residential Index (PIRI 100)

Annual change in luxury residential prices in 2022: Global top five

Average annual change by market type: Global top five

Average annual change by world region: Global top five

Measuring the slowdown

Average annual % change by property type

Average annual % change by world region