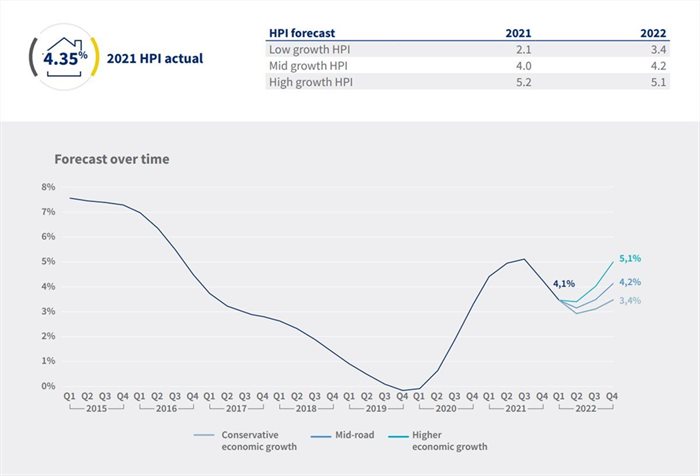

According to Lightstone Property's latest house price inflation (HPI) forecast, homeowners can expect favourable HPI growth in 2022, with this year set to mirror what was achieved in 2021.

HPI ended 2021 just above Lightstone’s mid growth HPI scenario of 4% – and the expectation is that HPI in 2022 will finish somewhere between 3.4% and 5.1%. Lightstone sets its low growth HPI scenario forecast significantly higher than the 2021 scenario, suggesting the residential market has weathered the worst of the pandemic storms.

Forecast and reality in 2021

HPI in 2021 was 4.35%, slightly above Lightstone’s mid growth HPI scenario where an end-of-year HPI of 4.0% was predicted.

The expectation was that under such a scenario HPI would mirror the consumer price index (CPI).

This scenario was predicated on economic growth recovering to pre-Covid-19 levels but without the serious economic reforms needed to set South Africa up for strong longer-term growth.

It also took into account the historically low interest rate environment, and a growing response from a market segment to the work-from-home trend, a feature of the 2021 high growth HPI scenario.

HPI scenarios in 2022

Lightstone scenarios for 2022 are based on assumptions around the key factors that influence house prices, which include:

Gross domestic product (GDP) growth

GDP growth is the strongest driver of sustainable house price growth. Lightstone has tested three likely GDP scenarios and the best case puts GDP growth at 3%, while a more realistic estimate would be 2% with a low estimate at a pedestrian 1.5%.

These estimates are in line with other economists, many of whom forecast GDP growth from around 1.9% to just above 2% in 2022, with inflation around 4.6%. However, projections are that GDP growth will slip in 2023 to around 1.8%, although economic reforms could lead to revising these predictions upwards.

Consumer Price Index (CPI) inflation

Apart from GDP growth, Lightstone expects the Reserve Bank to effectively manage CPI in the 3% to 6% target band, setting the repo rate as one of the tools to achieve this.

Stats SA defines CPI as a measure of “monthly changes in prices for a range of consumer products. Changes in the CPI record the rate of inflation. The CPI can also be used as a cost-of-living index”.

Looking at both GDP growth and CPI inflation, Lightstone’s high growth GDP scenario assumes a CPI inflation figure at the top end of the target band at 5.5%.

Lightstone analysts believe that it is more likely that CPI will end the year closer to 5% (the assumption made for the mid-growth GDP estimate). Further predictions show that CPI inflation will end the year at 4.5% for the low growth GDP estimate.

Depending on which scenario plays out, Lightstone analysts expect the Reserve Bank to increase interest rates by a cumulative 50 to 150 basis points during the year as it seeks to manage CPI inflation while also improving South Africa’s appeal as a foreign investment destination.

Projected HPI growth scenarios

Low growth scenario:

Under the low HPI growth scenario, Lightstone would expect this trend to continue throughout the first two quarters of 2022 before bottoming out and recovering slightly at the end of the year at 3.4% - a comparative increase on the low-end projected 12 months ago.

Mid growth scenario:

It is likely though that slightly stronger economic growth and less aggressive interest rate hikes in the first two quarters of the year should lead to a softer landing with house price growth stabilising in the second quarter and picking up in the third and fourth. The outcome of this is Lightstone’s mid growth HPI scenario, where they expect house price inflation to close the year at 4.2%, closer to where it started in 2022.

High growth scenario:

In a more optimistic high economic growth scenario, Lightstone expects house price inflation to rapidly recover in the second quarter with strong momentum going into the third and fourth quarter, resulting in an end-of-year house price inflation of 5.1%. This would, however, require positive economic reforms resulting in a 3% GDP growth for the year.

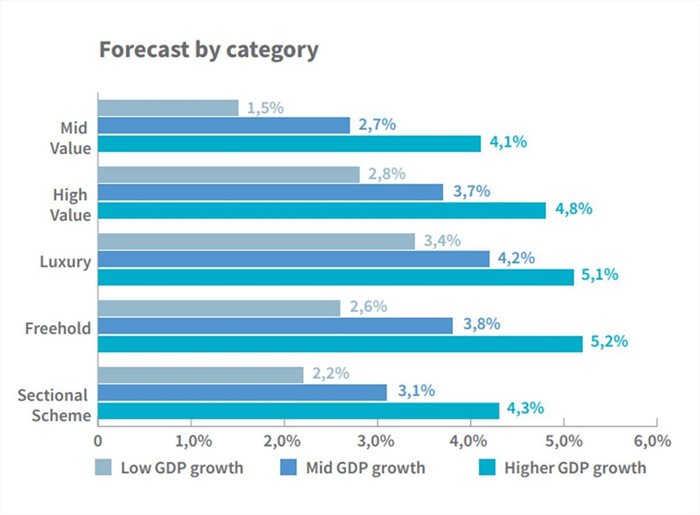

Projected winners and losers by market segment

Freehold properties – especially in the luxury market segment – could end the year with HPI at over 5% if high economic growth and lower interest rate increases prevail. This is typically because a large portion of these higher valued properties have bigger mortgages attached to them, and are therefore more responsive to positive changes in the macro-economic environment.

The mid-value market segment entered 2022 on a discouraging downward HPI trend and is set for a difficult recovery, especially under a low growth economic scenario, where HPI for this segment might drop to just 1.5%.

“As Covid-19 appears to become more manageable and its status transitions from pandemic to endemic, the conditions for economic renewal become easier. In particular, the tourism industry will begin the task of reclaiming lost international markets and commerce and industry will accelerate recovery to pre-pandemic levels. All eyes will, however, be on policies and programmes initiated by the South African government because economic reforms will lay the foundation for better than anticipated growth – which in turn will benefit the residential market and help attain the high growth HPI scenario,” says head of digital at Lightstone, Hayley Ivins-Downes.