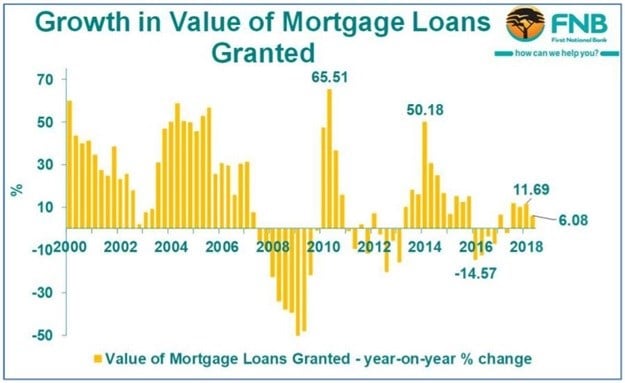

Second quarter 2018 SARB New Mortgage Lending data, released in the latest SARB Quarterly Bulletin, showed slower year-on-year growth in the value of new mortgage loans granted compared to the previous quarter.

New commercial mortgage loans granted slowed significantly, which appears in line with economic fundamentals, while the residential component was still attempting to “defy economic gravity”.

The data showed the value of new mortgage loans granted (residential, commercial and farms) to have grown at a year-on-year rate of 6.08% in Q2 of 2018, down from the 11.69% rate registered in the previous quarter.

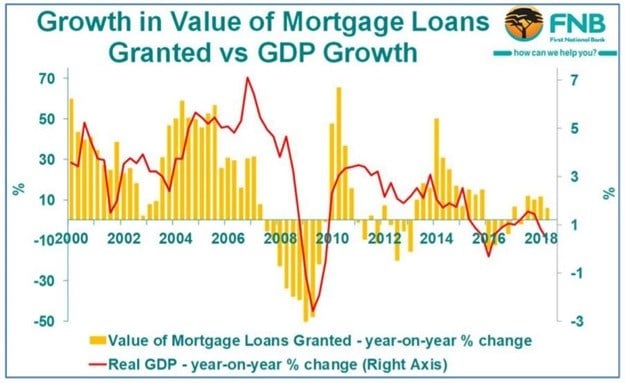

In a “healthy” property market free of “irrational, over-exuberant and speculative” behaviour, new mortgage lending growth direction should be driven largely by economic fundamentals, and to a significant degree this appears to be the case.

While new mortgage lending can sometimes lead real GDP growth, there is a broad correlation with the direction of GDP growth, and in recent times new mortgage lending appears to have actually lagged the recent renewed slide in real GDP growth.

Both new mortgage lending and real GDP growth showed “mini-recoveries” through 2016/17. However, the first half of 2018 has seen real GDP growth slow from 1.4% at the end of 2017 to 0.4% year-on-year by the second quarter of this year, and this renewed economic growth weakening is believed to have been key in the “lagged” slowing in second quarter new mortgage lending growth.

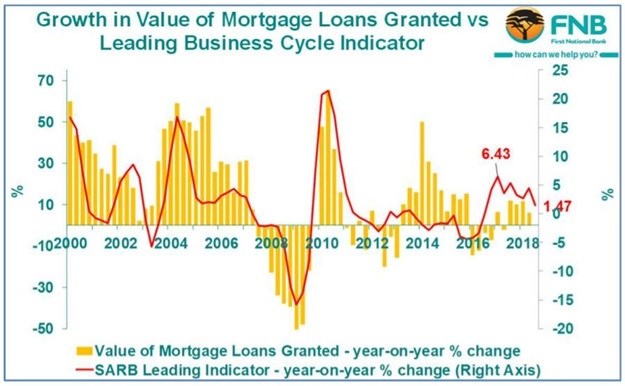

With new mortgage lending often being a more “leading” part of the economy, we see that its cyclical turning points are traditionally more in line, timing-wise, with the SARB Leading Business Cycle Indicator.

This indicator had seen its “mini-recovery” in year-on-year growth peak at 6.43% as at the start of 2017, where-after it has broadly slowed to 1.47% by the third quarter-to-date of 2018, thereby arguably “predicting” that we have been due for slower new mortgage lending growth after that mildly improved period in 2017/early-2018.

In short, two key economic indicators, the SARB Leading Indicator and the real GDP growth rate of late, have both suggested that we have been due for slower growth in new mortgage lending, and indeed the SARB second quarter mortgage data points to one slower quarter’s growth having emerged.

Commercial mortgage loans largely responsible for Q2 slowing

The large residential mortgage sub-component actually showed mildly faster growth in the second quarter of 2018, accelerating from 1% year-on-year in the first quarter to 7.4%. This arguably speaks to evidence of a more competitive residential mortgage lending sector, where lenders as a group may have been increasing their risk appetite and being more competitive on home loan pricing, in an attempt to grow lending in weak market times, thereby defying “economic gravity” to a small extent.

However, the second major sub-sector, i.e. the commercial mortgage loans segment, appears to be “going with the economic flow” of late, its year-on-year growth having subsided markedly from a two-year high of 33.4% in the first quarter of 2018 to a lowly 3.2% in the second quarter.

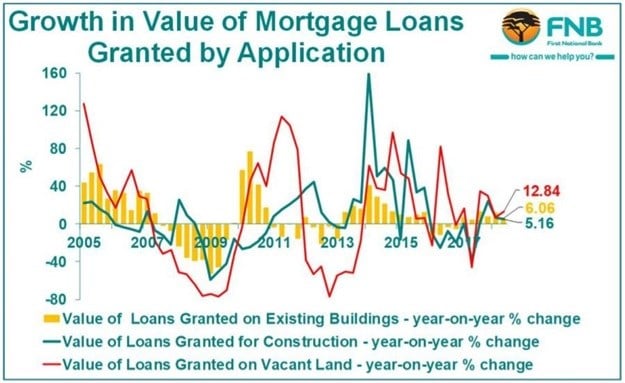

Mortgages by application show little in the way of divergence between applications

Viewing new mortgage loans granted “by application”, i.e. on existing buildings vs vacant land vs for new construction, we have seen recent growth slowdowns in all three applications.

Growth in mortgage loans granted for vacant land found itself rising by 12.84% year-on-year in the second quarter, and while this small volatile segment is slightly up from first quarter growth, it is well down from a 34.6% high in the third quarter of 2017. This category is highly sensitive to economic cycles, and therefore unlikely to strengthen in the near term. Growth in new mortgage loans granted for construction has slowed from 24% year-on-year as at the final quarter of 2017 to 5.16% in the second quarter of 2018. Mortgage loans granted on existing buildings grew at a slower 6.06% year-on-year in the second quarter compared with 12.3% in the previous quarter.

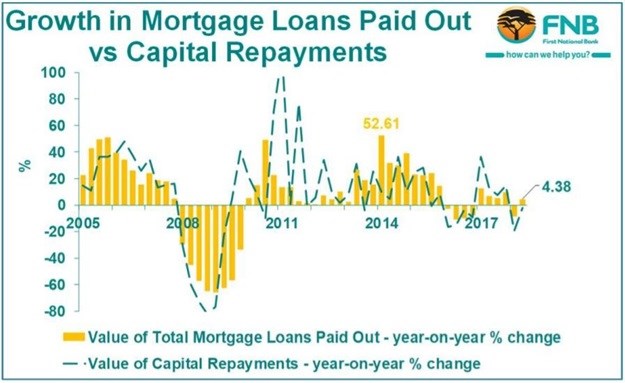

New loans paid out vs capital repayments

New mortgage loans paid out saw a second quarter growth acceleration, out of negative growth, to reach 4.38% year-on-year in the second quarter of 2018. Such a mild strengthening says little, however, as payouts will typically lag credit granted trends.

The value of capital repayments typically tracks the direction of payouts, and also “accelerated” in a sense in that its negative growth diminished from -19.5% in the first quarter of 2018 to -2% in the second quarter.

After something of a “mini-recovery” in new mortgage loans granted through 2017 to early-2018, the second quarter showed a renewed slowing in this growth.

The slowing in growth comes as no surprise, as economic growth has slowed for two consecutive quarters after a “mini-recovery” through 2017. New mortgage lending, in a healthy functioning and “rational” market should broadly track the direction of economic fundamentals with the customary leads or lags.

Of the two major mortgage sectors, it was noticeably slower growth in commercial mortgage that was responsible for the overall slowdown in new mortgage loans granted.