The South African Retirement Industry is undergoing a transformation designed to ensure members get a better deal when saving for retirement. Due to proposed legislative changes and increased pressure on governance and cost management, both global and South African companies are moving towards Umbrella Fund Solutions.

Marriott launched its Umbrella Solution in early 2014 taking the suggestions of National Treasury's retirement reform into account.

Lourens Coetzee

"Marriott's Umbrella Solution meets the needs described by National Treasury by providing a simple, tax-effective and low-cost solution for employers wishing to provide their employees with a means to save for retirement," explained Lourens Coetzee, an Investment Professional at Marriott Asset Management.

The Marriott Umbrella Solution is run by a board with an independent trustee majority and has an all-in fee of 1.14% (incl. VAT). This fee includes all asset management, administration and operating costs. There are no performance fees so members know exactly what the total cost of the product is.

"This fee compares favourably to other South African Commercial Umbrella Funds which have an average fee closer to 2% as highlighted in the technical paper on charges by National Treasury," said Coetzee.

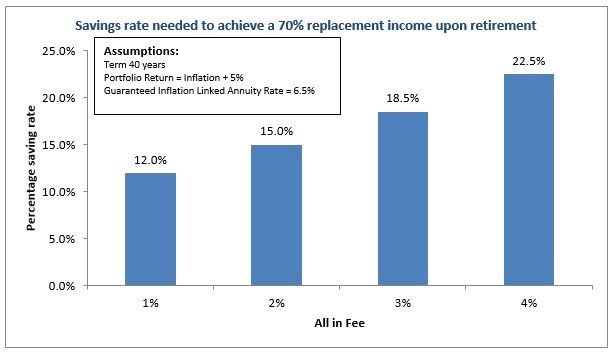

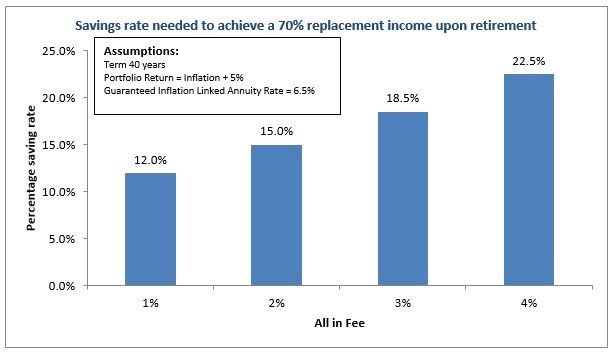

Fees have a significant impact on the retirement outcome over a 40 year period and it is therefore vitally important that members understand what they are paying. The chart below illustrates the impact of fees on the amount a member will need to save in order to replace 70% of their income at retirement. If the all-in fee is 2% members need to save approximately 15% of their salary for 40 uninterrupted years. A reduction in fee to 1% means members only need to save 12% of their salary, a 20% reduction in contributions.

Source: Marriott

Calculating the total cost of umbrella funds can however be difficult. Some fees are charged as a percentage of assets, others are charged as a percentage of contributions, and some fees are even charged as a fixed monthly fee. These complexities make it difficult to compare products and to fully understand the total costs involved.

The effect of a fixed monthly fee as an example can be significant depending on a member's salary. A fixed monthly fee of R40 a month means something completely different to Employee A, who earns R10 000 a month and Employee B who earns R20 000 a month.

In this example, both employees are contributing 10% of their monthly salary to their retirement fund. Their monthly contributions would be R1000 and R2000 respectively but their fixed monthly fee as a percentage of their contributions would be 4% for Employee A compared to 2% for Employee B. The lower a member's salary the more significant a fixed monthly fee becomes.

Marriott's Umbrella Fund Solution, with an all-inclusive fee of 1.14% and an independent trustee majority, is therefore a good choice for employers. "It answers many of the questions National Treasury is asking on transparency, efficiency, suitability and affordability," said Coetzee.