According to Ooba's statistics for the second quarter of 2023, while the interest rate hikes since November 2021, have negatively impacted the numer of home loan applications, they have not influenced the willingness of banks to continue to lend competitively.

Source: Gallo/Getty

“Homebuyers are still benefiting from competitive home loan deals. Our statistics show that the banks are still comfortable to offer 100% loans - with approval rates still sitting at over 80%,” notes Rhys Dyer, CEO of Ooba Home Loans.

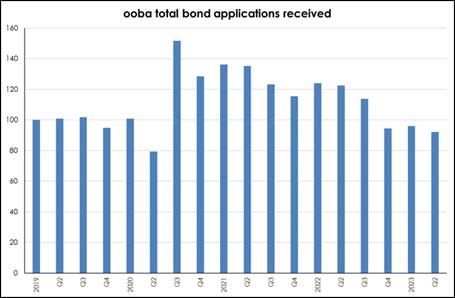

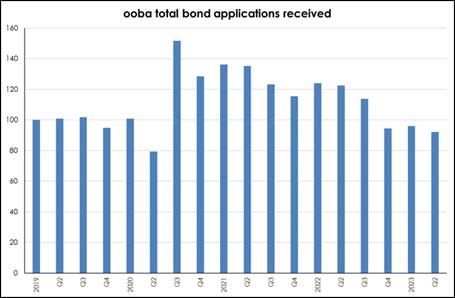

Rapid interest rate hikes dent the volumes of home loan applications

“As expected, property sales have slowed due to the high-interest rate environment and challenging economic conditions,” says Dyer.

Ooba’s latest statistics point to a decline in the volume of home loan applications by 25% year-on-year (from Q2 2022 to Q2 2023) and by 30% from the high in Q3 2021 when the prime lending rate was at a historical low of 7%.

Source: Ooba Home Loans

Property price growth muted

The average price that Ooba customers are paying for property remains in negative territory, with the average purchase price for Q2 2023 down by -0.4% from Q2 2022 (from R1,431,712 to R1,426,656). The average purchase price recorded for first-time homebuyers in Q2 2023 was R1,120,173, -2.6% down on Q2 2022’s R1,150,256.

“This is in reaction to the rapid rise in interest rates - which climbed 475 basis points since the start of the rates hike cycle in November 2021, resulting in weakening demand for property,” explains Dyer.

Source: Ooba Home Loans

While the property price decline is good news for new homebuyers, an end to the current interest rate hiking cycle is needed to stimulate renewed demand for residential property and stabilise the market.

“The recent decision by the South African Reserve Bank to leave the interest rate unchanged is great news for the property sector, with an expectation that we have reached the top of the cycle and that the next interest rate movement will be downwards,” says Dyer.

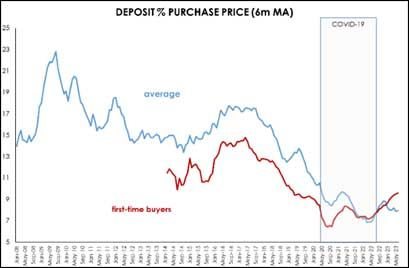

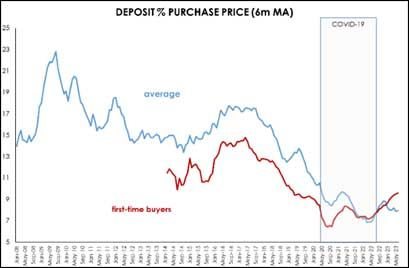

Good habits evident in healthy deposits

While banks continue to offer zero-deposit home loans to homebuyers, Ooba's statistics show that savvy homebuyers are prioritising deposits, with positive outcomes for their long-term savings and general affordability.

“The size of the average deposit has grown from 7.5% of the purchase price in Q1 2023 to a sizeable 8.4% in Q2 2023 (R120,343). This signals that homebuyers are utilising their deposit to minimise their exposure to the effects of the increased interest rates and to ensure affordability of the properties they are purchasing,” continues Dyer.

And despite a decline in first-time homebuyer applications - now accounting for 46.5% in June 2023 (and 48.2% for Q2 2023) - down from its peak at 56.2% in May 2020, this valued segment still believes in the power of deposits.

“Deposits now make up 9.6% of the purchase price (R107,917) for first-time homebuyers – a staggering 15.2% increase year-on-year,” says Dyer.

Source: Ooba Home Loans

Banks remain competitive

Despite the higher interest rate environment, banks continue to compete for homebuyers, as evidenced by a steady average successful approval rate.

In addition, the approval rate for 100% loans is stabilising to just above 80% - rising to 81.9% in June 2023 from 80.2% in May 2023.

“This removes some of the barriers to entry for homebuyers – particularly first-time homebuyers who cannot afford to put down a deposit,” says Dyer.

However, it’s interesting to note that the number of people declined by the first bank that they applied to has increased slightly from 33.6% in Q1 2023 to 34.6% in Q2 2023.

“This is the effects of high interest rates coupled with the rising cost of living on applicants’ affordability profiles. Despite this, our approval rate remains higher than the previous quarter, highlighting the critical importance of receiving quotes from a number of banks when applying for a home loan.

“Despite the rate hikes and pressure on consumers, banks are still lending, and this should come as a confidence booster to many of us,” comments Dyer.

“We are at the peak of the interest rate cycle, which means that the homebuyers who can afford a home loan at the current interest rate are a good risk going forward.”

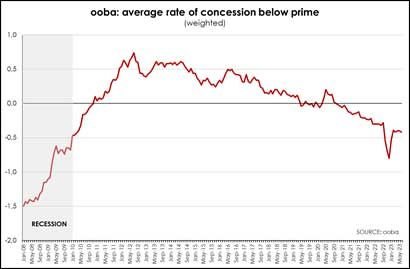

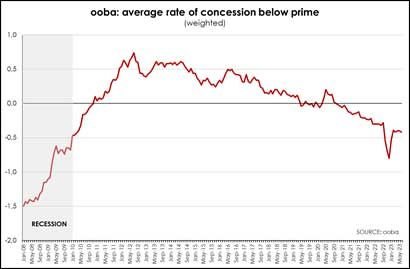

Homebuyers benefit from banks competing for home loans

The banks’ competitiveness for a bigger share of the smaller home loans market is illustrated in the cheaper year-on-year average interest rate concession. “In Q2 2022, Ooba Home Loans achieved an average rate below prime -0.30%, compared to the now improved average rate for Q2 2023 of -0.41% below prime.”

Source: Ooba Home Loans

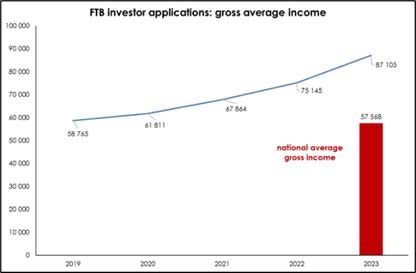

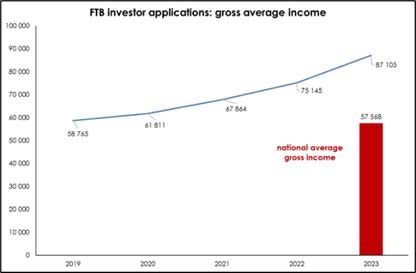

First-time homebuyers take advantage of property investment opportunities

An increase in gross incomes nationally has led to homebuyers exercising their option to purchase investment properties. According to Ooba, the gross income of all applicants during the first half of 2023, averaged R57,568. Interestingly, the gross income of first-time property investors was significantly higher – averaging R87,105 for the same period.

Source: Ooba Home Loans

The income level of first-time property investors has increased sharply in recent years from +9.8% in 2021 to +10.7% in 2022 and most recently to +15.9% in 2023. Coupled with this, the applications for investment/buy-to-rent properties rose sharply in June 2023 to a robust 10.9% of total applications nationally - the highest percentage recorded since February 2009.

The primary driver behind the national increase is the Western Cape, which saw applications for investment properties surge to 30.4% of total applications in the Western Cape in June, comfortably exceeding the previous high of 21.5% in March 2020.

“Other regions recording stronger demand in the last month were the Free State (8.3% of applications) and the Northern Province (5.2%),” adds Dyer.

Somewhat surprisingly, the average price paid by first-time homebuyers for an investment/rental property has, in recent years, exceeded that of first-time homebuyers overall. “We attribute this to the perception of residential property as a sound investment opportunity and the aforementioned improvements in income levels,” says Dyer.

Also noteworthy is the finding that the average age of first-time homebuyers purchasing a residential property for investment purposes has declined since 2019, from 41 years to 34 years.

“This is in line with global trends as younger homebuyers prioritise homeownership as a strategic tool for wealth creation and financial security,” elaborates Dyer.

Looking ahead

The decision not to increase interest rates further this month is a great message for the property market, however, Dyer envisages that activity in South Africa’s housing market will likely remain subdued until there is a shift to an interest rate-cutting cycle.

“We anticipate below-average demand and modest property price growth in the short term. Weaker home-buying activity will support the investor market as the demand for rental properties increases. Approval rates and the current level of interest rate discounts should hold steady whilst banks continue to compete for good-quality home loans amongst a smaller pool of buyers.

“The best avenue for serious buyers is to shop around and negotiate the best deal on a home loan. With more affordable property prices and banks offering home loans on favourable terms, this could be one of the best times to purchase property,” he concludes.