Repo rate unchanged at 6.75%

The repurchase rate remains unchanged at 6.75% per year, says Reserve Bank Governor, Lesetja Kganyago.

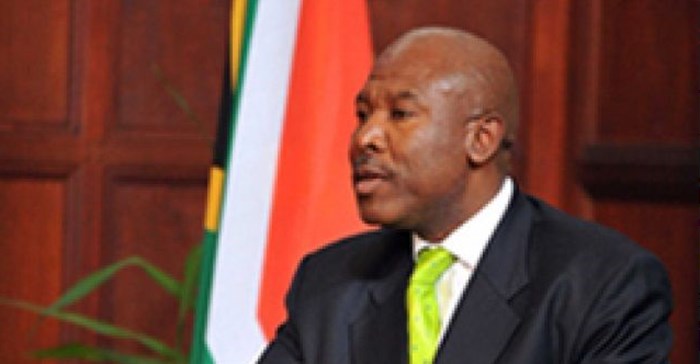

Reserve Bank Governor Lesetja Kganyago

The monetary policy actions will continue to focus on anchoring inflation expectations closer to the mid-point of the inflation target, in the interest of balanced and sustainable growth. International developments have been the major contributor to an improved inflation outlook since November 2018.

“Significant declines in international oil prices and a less depreciated exchange rate have been key drivers of this improved outlook. Domestic petrol prices decreased by a cumulative R3.07 per litre (for 95 unleaded in Gauteng) in December and January. Lower food price inflation also contributed to lower consumer price inflation. The economy’s recovery from the technical recession in the first half of 2018 is welcomed, but it remains modest, with growth constrained by subdued demand as a result of weaker levels of consumer and business confidence,” he says.

Headline CPI inflation is now expected to peak at around 5.6%, in the first quarter of 2020. Core inflation is expected remain unchanged at 4.3% in 2018 and forecast to average 5.0% in 2019 (down from 5.3%), 5.1% in 2020 (down from 5.5%) and 4.8% in 2021.

Kganyago says the domestic growth outlook remains sluggish.

“Although, GDP increased by 2.2% in the third quarter of 2018, private sector fixed investment remains weak and production in key sectors is volatile. The SARB now expects growth in 2018 to have averaged 0.7% (up from 0.6% in November).”

The growth forecast for 2019 is 1.7% (down from 1.9%), it is unchanged at 2.0% for 2020 and increases to 2.2% in 2021.

Commentary

"Although it is mainly to structural economic reforms that SA must look for future sustained economic growth, neither should monetary policy hamper it at the current vulnerable point in the business cycle. Monetary policy should therefore continue to give the economic recovery, which is still slow and patchy, and 'sluggish' according to the MPC, the benefit of the doubt," says Professor Raymond Parsons from the North West University School of Business and Governance.

"The governor again emphasised the aim of targeting the mid-point of the inflation band (3%-6%) which could come under pressure from possible increases in administered prices in SA. The counteracting forces of lower inflation forecasts, together with specific inflation risks to the upside means that a benign interest rate path may materialise, especially given that global central banks have hinted at fewer rate hikes going forward," says Luigi Marinus, portfolio manager at PPS investments.

Related

Global trade fears keep South Africa’s interest rates on hold 20 Mar 2025 #Budget2025: Unlocking mining's full potential could reshape South Africa's economy 13 Mar 2025 North-West University Business School Prof Raymond Parson comments on 4Q 2024 GDP growth figures 7 Mar 2025 Government urged to push structural reforms as South Africa's GDP grows 0.6% 5 Mar 2025 SA's Budget delay: National Treasury's next steps and fiscal risks 19 Feb 2025 #Sona2025: President Ramaphosa's bold plans for urban renewal and housing 7 Feb 2025