Subscribe & Follow

Advertise your job vacancies

South Africa needs a radical rethink about how it runs its economy

Since South Africa adopted an inflation targeting policy regime in 2000, there have been growing concerns that its Reserve Bank is being rigid with its sole focus on price stability -- inflation control. The chorus of disapproval of the policy regime becomes loudest when the benchmark interest rate is raised, particularly, in the midst of weak growth and high unemployment rates.

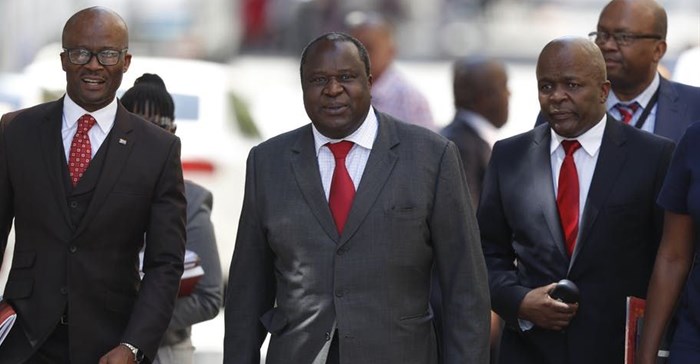

South Africa’s Finance Minister Tito Mboweni (centre) arrives to deliver the mid-term budget statement to Parliament. EPA-EFE/Nic Bothma

The leading trade union federation, Cosatu, is the most vociferous in its objection to inflation targeting. For its part, the bank has always been quick to remind critics that its mandate is set out in the Reserve Bank Act of 1989 as:

The primary objective of the Bank shall be to protect the value of the currency of the Republic of South Africa in the interest of balanced and sustainable economic growth in the Republic.

One of the few countries that has a central bank with a broader mandate is the United States. The Federal Reserve Board Act states that its job is to “maintain long run growth” with a view to increasing production so as to promote the goals of maximum employment, stable prices, and moderate long-term interest rates.

I would argue that this brief works for the Fed. But it wouldn’t work for a small open economy like South Africa. Any attempt to push the South African Reserve Bank to explicitly target output growth and full employment, in addition to its objective of ensuring price stability, would be a recipe for disaster.

I’m also of the view that demanding a review of the inflation targeting framework is akin to barking up the wrong tree. South Africa’s anaemic economic growth and incredibly high unemployment can’t be fixed by monetary policy alone. The Reserve Bank’s role in directly influencing economic growth is acutely limited. Cutting or raising interest rates can only do so much.

A job for the Treasury, not the bank

In the present scheme of things, monetary policy tools – such as raising or cutting interest rates – have reached their limit. It is fiscal policy – decisions by National Treasury to increase spending, raise taxes – that requires attention.

The challenges of low growth, high unemployment and widespread poverty are so pressing that a radical shift of policy is urgently needed. It’s time South Africa lived up to the mantra that it’s a developmental state. In other words, the use of macroeconomic planning by an activist state. Examples from elsewhere in the world include the early stages of the economic development efforts of successful East Asia countries.

Policies and economic planning needs to be refocused in a way that harnesses the strength of markets, but also uses the full force of the state to address the country’s daunting challenges of pedestrian economic growth and excruciating unemployment.

No country has developed in the 21st Century through dogmatic obsession with markets. The reality of gross market failure – and the fact that market economies result in large numbers of people being vulnerable – makes unquestioned reliance on the market ridiculous.

South Africa could achieve this balance by taking a few simple steps.

Steps in the right direction

First, it should adopt a medium term development plan rather than simply relying on its current budgeting processes. For instance, the flagship policy instrument, the Medium Term Budget Policy Statement, has outlived its usefulness. This cocktail of policies are essentially highlights of expenditure priorities and division of revenue. A far more profitable approach should be adopted: a comprehensive planning framework that pulls together the myriad economic and social aspirations with well-defined outcomes that speak to the country’s challenges.

This practice would also end the current piecemeal approach of implementing a myriad of ad-hoc plans such as an industrial plan, sectoral plans and black industrialist programme. Successful Asian countries such as South Korea, Taiwan and Singapore all adopted medium term development planning frameworks. These were supported by markets where necessary.

Thinking outside the box, as the Finance Minister, Tito Mboweni suggests, requires a profound shift from the old approach to economic management.

This article is republished from The Conversation under a Creative Commons license. Read the original article.![]()

Source: The Conversation Africa

The Conversation Africa is an independent source of news and views from the academic and research community. Its aim is to promote better understanding of current affairs and complex issues, and allow for a better quality of public discourse and conversation.

Go to: https://theconversation.com/africa