Subscribe & Follow

Advertise your job vacancies

Jobs

- Bookings Clerk Stellenbosch

- Dealer Branding and Development Coordinator Johannesburg North

- New Vehicle Sales Manager - Volkswagen Experience East Rand

- New Vehicle Sales Manager Secunda

- Warranty Clerk - Stellantis Experience Richards Bay

- New Vehicle Sales Executive Centurion

- Sales Representative Johannesburg

- Area Sales Manager East Rand

- Vehicle Sales Executive West Rand

- Sales Representative Johannesburg

New vehicle sales in June decline as expected

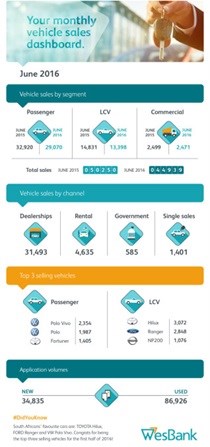

The new vehicle industry sales continued its decline in June. Aggregated sales data from the National Association of Automobile Manufacturers of South Africa (Naamsa) shows that industry sales were down 10.6%, year-on-year, with 44,939 new vehicles sold - 5,311 fewer than the same period in 2015.

Total industry sales are down 9.9%, year-to-date. This comprises respective declines of 10.4% and 8.9% for the passenger car and light commercial vehicle (LCV) segments.

Passenger car sales through the dealer channel, where consumers are most active, plummeted 17.8% – correlating strongly with the decline in applications for new vehicle finance. This decline is indicative of new car price inflation and pressure on consumer budgets, which has resulted in a migration to the used market. Despite this, LCV sales through the dealer channel rose 4.8% on the back of highly anticipated new model arrivals, including the new Toyota Hilux and Ford Ranger.

Macroeconomic factors

The rental channel also saw a surge in demand in June. Vehicle sales to rental companies were up 43.7%, year-on-year. That contributes to the 47.7% growth for this channel, year-to-date.

“This sales performance is in line with our forecast for the year, and it’s been informed by a number of macroeconomic factors. The rand has struggled, interest rates have been hiked and inflation has taken its toll on household budgets,” said Simphiwe Nghona, CEO of WesBank Motor Retail. “New model introductions have been positive for the LCV segment, as these vehicles are clearly popular with consumers. However, the passenger car market is under tremendous stress due to consumer affordability.”

WesBank’s internal data shows a corresponding decline in vehicle loan applications. During June, application volumes for new vehicle loans fell 19.2%, year-on-year. In contrast, demand for pre-owned vehicles weakened slightly by 0.2%. Consumers who are buying vehicles are also spending more, in line with new car price inflation as well as increasing demand in the used market. The average deal value for a new vehicle grew to R291,000 this past month – an increase of 11%, year-on-year. Average deal for used cars rose 10%, to R188,000.

“As new vehicle sales continue to decline it will start drawing more attention to affordability and factors that affect consumers’ budgets,” said Nghona. “Fuel price increases, interest rates hikes and rising inflation will continue eating into disposable income. Those with high levels of debt may soon find themselves in financial trouble. More prudent consumers will also be affected, and may have to scale back their dreams of buying a new car.”

Related

SA automotive sales stumble as export challenges intensify 3 Oct 2024 July 2024 sees a rise in car sales, but exports face declines 5 Aug 2024 Election jitters hit May 2024 vehicle sales hard: All the stats 4 Jun 2024 SA’s best-selling automakers in March 2024 3 Apr 2024 Economic strain impacts August new vehicle sales 4 Sep 2023 SA's new vehicle sales perform better than expected in April 2023 4 May 2023