2020 has been a shot of adrenaline to the e-commerce sector, with the Covid-19 pandemic boosting adoption rates across the board. It is estimated that the 1-2% hold the sector had in the retail space will double to as much as a 2-4% share by the end of the year.

Jonathan Smit, PayFast founder and MD

To better understand the boom in the e-commerce market, online payment gateway PayFast has launched its first Ecommerce Performance Index – the PEP Index.

“We saw a 100% increase in online transactions between April and May 2020, this is in line with growth seen in established e-commerce markets across the globe,” says Jonathan Smit, managing director and founder of PayFast.

“The PEP Index focuses on how this surge impacted local merchants and what the industry boom looks like in a South African context.”

The report consists of industry, payment and buyer data sourced from PayFast platforms over the past year. The analysis demonstrates the impact of the pandemic on e-commerce from the perspective of merchants and consumers.

“As a digital payments provider, we find ourselves at an intersection of data, which provides unique insights into e-commerce drivers and online shopping habits in South Africa,” says Smit.

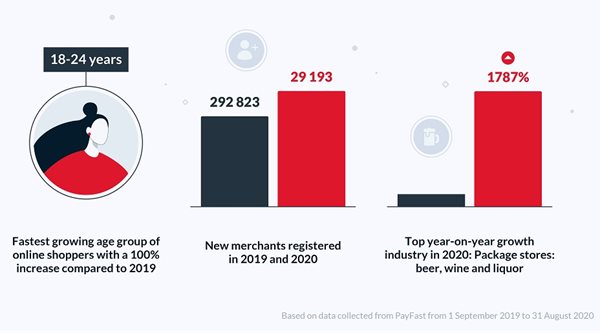

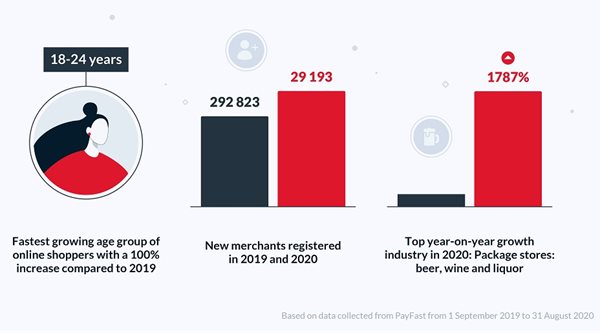

Credit: PEP Index

On a global scale, Covid-19 has set a high bar for what will be considered as baseline e-commerce growth going forward. Reflecting on data taken from Black Friday in 2019, PayFast saw a 50% increase in total payment volumes from October to November 2019.

When e-commerce logistics restrictions were lifted in May, online payment volumes rose by 98%. This growth has been sustained throughout the rest of the year, making for an interesting trend ahead of the coming Black Friday / Cyber Monday weekend.

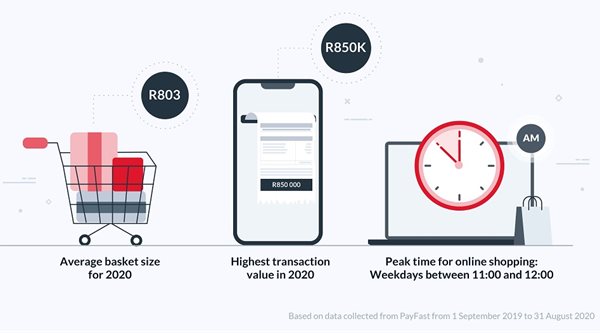

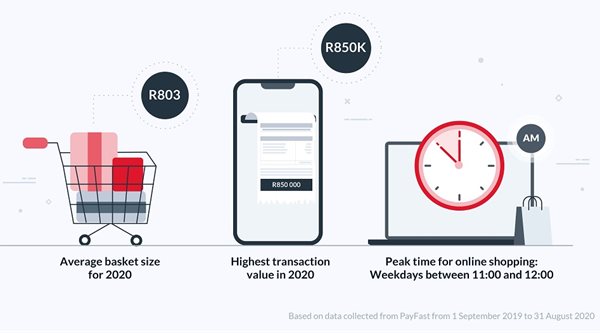

Credit: PEP Index

To understand the direct impact that lockdown had on local e-commerce businesses, PayFast conducted a broad survey across its merchant database.

“The pandemic forced businesses to shift to digital or face shutting down. Around 60% of merchants noted a shift in sales from physical outlets to online stores since March, with 42% reporting an increase in revenue over lockdown,” says Smit.

Broadening the scope of the industry-wide analysis, the PEP Index includes findings from key industry players such as uAfrica, WooCommerce, Mobicred, the Insaka eCommerce Academy and Snatcher.

The 2020 edition of the PEP Index is available for download here.