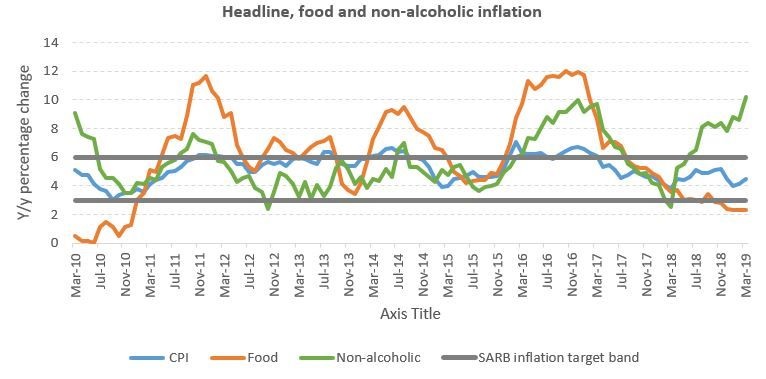

Another fuel price hike in March 2019 led to inflation hitting the midpoint of the Reserve Bank's 3% - 6% target range. The annual headline consumer inflation accelerated to 4.5% in March 2019, from 4.1% in February 2019. After a remission at the end of 2019 and in January, fuel prices rose again in February and March 2019.

At the beginning of March, the petrol price went up by 74 cents a litre, which contrasted with the decrease in the petrol price of 36 cents during the same month last year. As a result, the year-on-year fuel component of inflation shot up to 8.8% in March 2019, from 0.9% in February 2019 and -1.2% in January 2019.

Bearing in mind that fuel has a weighting of 4.58% within the overall consumer price index (CPI), this 8% increase in the fuel inflation rate on its own accounted for almost the entire 0.4% rise in the overall head inflation rate.

Source: Author, compiled from Stats SA data

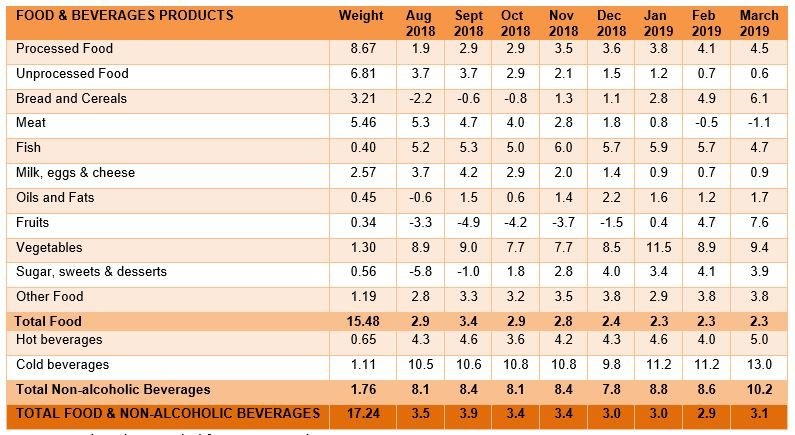

Food inflation remained unchanged at a decade-long low of 2.3%, for the third consecutive month. However, looking at a broader category that includes non-alcoholic beverages, food inflation accelerated slightly to 3.1% in March 2019, from 2.9% in February 2019.

A closer analysis of the underlying components of the food inflation basket shows that inflation is rising quite significantly in respect of many of the food categories, including bread and cereals, oils and fats, fruit and vegetables.

Food and non-alcoholic inflation (CPI perspective)

Source: Land Bank, compiled from Stats SA data

The annual inflation rate of bread and cereals rose quite strongly over the past few months, reaching 6.1% in March 2019 compared to 4.9% in February 2019. Drought conditions during the planting period in the north-western regions of the country, mainly North West and Free State, caused staple food commodity prices such as maize and soya to rise quite strongly.

The effects are starting to be felt, hence a significance increase in bread and cereals inflation in March 2019. It is estimated that the current SAFEX white and yellow maize prices are more than 20% more than what they were during the same period last year.

The vegetable prices showed an alarming annual inflation rate of 9.4% in March 2019, from 8.9% in February 2019. Fruit prices also showed a startling increase in the annual inflation rate of 7.6% in March 2019, from 4.7% in February 2019. This is as a result of lower supplies of vegetables seen recently as a result of seasonality and drought conditions in certain parts of the country. It is therefore expected that vegetable prices will somewhat decelerate in the next months as supplies normalise.

Meat inflation continued to decelerate, dropping to -1.1% in March 2019, from -0.5% in February 2019, thus extending a decline that has continued virtually unabated since the 15.6% peak in meat inflation rate was recorded in September 2017. This has somewhat prevented the overall food inflation rate from rising.

The decline in meat inflation was largely due to an increase in domestic supplies as a result of local suppliers being forced to sell to the domestic market instead of exporting because of a ban on such exports by neighbouring states out of the fear of the effects of foot-and-mouth-disease (FMD) in Limpopo.

The FMD has now been eliminated, so it is expected that the situation will normalise and meat inflation will begin to accelerate in a few months’ time. The increase in meat inflation is also likely to be supported by the expected increase in the poultry import tariff rate.

Food inflation is expected to gradually pick up with the beneficial impacts of the end of the drought gradually fading away. The normalisation in the meat industry will likely to result in meat inflation accelerating going forward as export markets that banned South Africa’s red meat suspend the export ban. In addition, maize prices are likely to rise as the lower harvest is expected this season compared to last season.

As such, food inflation is expected to average around 5% in 2019, which is still below the South African Reserve Bank inflation target band of 3% - 6%.

It is interesting to note from the above analysis that vegetable, fruits and bread and cereals inflation has accelerated in March 2019.

The inflation acceleration of these staple food has a major impact on the affordability of food, and this is particularly concerning to poor consumers who spend an estimated 12% of their income mainly on fruits and vegetables. This could result in poor consumers not affording to buy fruits and vegetables, thus resulting in a less balanced diet.