Over time, South Africa has experienced significant growth in its middle-class population1, having a major impact on the country's economy and consumer market. With this growth of the middle market, there is an increased demand for consumer goods, including cars. Data analysts have used new car sales as a strong measure of the middle class's financial health and purchasing power2.

According to consumer insights agency KLA’s YouGov Profiles, 30% of middle-class consumers have bought a car in the past 12 months with 50% of these consumers planning on buying a new car in the next 12 months, both significantly higher than the national population.

Two of the defining characteristics of middle-class car buyers, are functionality and value for money. When it comes to value for money, many middle-class buyers prioritise fuel-efficiency, over premium car features such as high-performance engines.

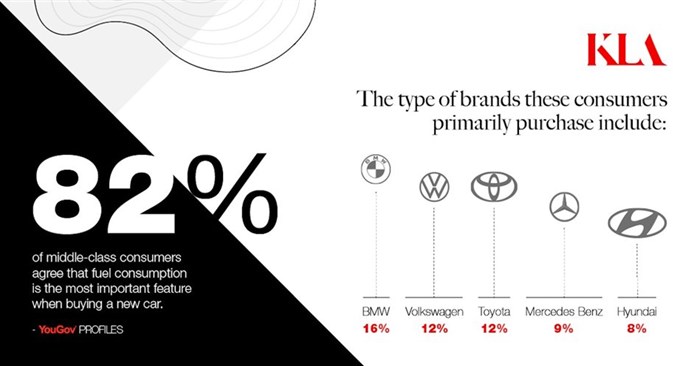

82% of middle-class consumers agree that fuel consumption is the most important feature when buying a new car

– YouGov ProfilesIt is also important for these consumers to have a car that is equipped with as many safety features as possible (86%) and is suitable for the whole family (90%), over luxury features such as heated seats and blind spot monitoring. This is particularly true for those who are buying their first car, as they are more likely to be using the car more frequently – 47% of these consumers use their car every day of the week, significantly higher than the national population.

The rise of the middle-class consumer in South Africa has had a significant impact on the country's automotive industry. Additionally, buying behaviour has shifted, with consumers using online platforms as a first point of contact to conduct research prior to purchasing, with autotrader.com (31%), cars.co.za (29%) and webuycars.co.za (21%) featuring in the top three.

The type of brands these consumers primarily purchase include:

With this changing consumer behaviour, it is important that brands keep abreast of these changes, with an understanding of these shifting customer needs to remain relevant and differentiated in a highly competitive industry.

If you would like to find out more about KLA’s YouGov offering or to find out more about how your brand performs, please visit www.kla.co.za or email az.oc.alk@seiriuqne.

Methodology:

Profiles: Segmentation and media planning YouGov tool. Data is collected daily. YouGov Profiles makes it simple to find and understand the audience that matters most to you. It gives you the power to build and customise a portrait of your consumers’ entire world with unrivalled granularity. More than 12,500 variables are available in South Africa.

Profiles data set: 2023.04.16

Target: Middle Income Earners (N~360)Notes:

1. Middle Class Earners have been defined as a household income of R40,000-R100,000 per month

2. Source: https://www.capetalk.co.za/articles/446434/turns-out-sa-has-a-robust-and-growing-middle-class-despite-concerns-study