What impact has Covid-19 had on businesses? And how can they bounce back? We ask 4,500 business leaders across the world.

The outlook is certainly quite gloomy for businesses, even with positive headlines about vaccines emerging more recently. According to Kantar’s Global Business Compass, our survey of nearly 4,500 business leaders across the world – over 900 of them C-suite, in 60+ markets and 40 global businesses – more than half of business leaders (57%) believe that the economic drag of the Covid-19 pandemic will last a year or more after the delivery of a vaccine, with more than one quarter (27%) expecting their business to take at least two years to fully recover from the crisis.

How we did business in 2020

More than two-thirds (69%) of businesses expected to end the second half of 2020 in decline, with one in six of those leaders expecting their business to be down in excess of 40% year-on-year. At least 54% of businesses expressed a requirement for continued support – primarily in the form of improved tax conditions or deferral of tax payments.

Focusing on the marketing function, we identified that almost two-thirds (61%) of companies had reduced their marketing spend in 2020 – the average decrease was 37%. Half of companies said they had cut communications and media spend, by an average of 39%. Where does that leave them, and what happens next?

How will businesses change in 2021?

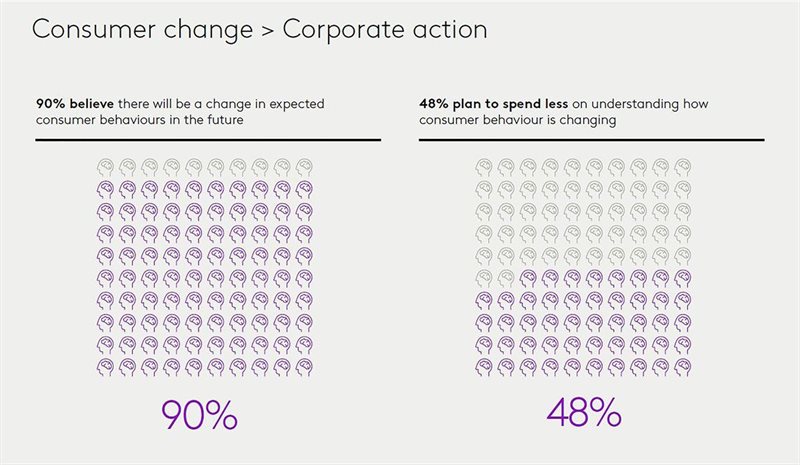

In the post-pandemic world, business leaders expect there will need to be a fundamental rethink of businesses and strategies: 90% of them expect changes to consumer behaviour established during the pandemic to persist post-crisis. Indeed, it would be fair to say that no recession to date has brought consumer change of this magnitude. But, interestingly, nearly half of those surveyed (48%) claimed they’d be spending less on understanding changing consumer behaviour.

So, what will they do differently? At least 64% of business leaders expect they will need to revisit their long-term strategic priorities, with 79% saying they need to evolve their core strategy, and 84% expecting to change the organisational structure. A total of 72% of those surveyed said they will be revisiting their ways of working, to embrace agility and flexibility. With widespread economic concern and severe constraints, we’ve identified the three core strategies marketing teams should pursue to support their business’s ‘rebound and recovery’ strategy.

Three imperatives for your rebound and recovery strategy

1. Purpose and sustainability

According to Kantar’s Global Monitor, 85% of consumers think it is important to buy from companies that support causes in which they believe. Kantar’s Covid-19 Barometer study, which explored how Covid-19 is influencing consumer behaviour, attitudes and expectations among more than 150,000 people in over 60 markets, also reveals the proportion of people aged 18 to 34 around the world stating that brands should ‘guide the change’ has increased from 20% to 27% over the course of lockdown.

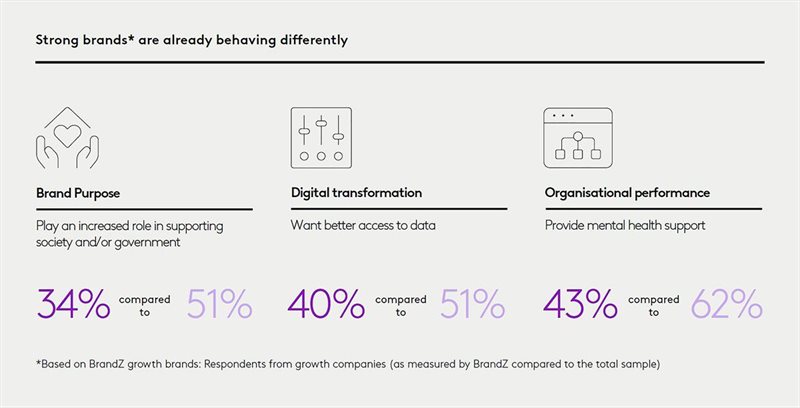

Moreover, our analysis finds that 51% of BrandZ Growth Brands play an active role in supporting society. Yet only 34% of companies plan to do just that.

Graham Staplehurst, Kantar 29 Sep 2020

We urge leaders to recognise the importance of a purpose-led strategy and the role of sustainability in their operating models, to ensure that they continue to remain relevant to this evolving customer base.

Marketing teams should reflect on what explicit or implicit needs are being met and consider the impact they can have on people’s lives, functionally or emotionally. Integrate purpose as a living element of the communication, product, brand experience and brand commitment, rather than treating it as an isolated concept.

2. Digital transformation

According to our Covid-19 Barometer, 40% of consumers say they have increased their e-commerce spend during lockdown, and 45% of consumers say they will continue shopping with online stores they found during the pandemic.

As a decade’s worth of incremental change takes place in a period of months, 95% of business leaders surveyed agreed that online spending will likely increase. But just 55% of companies say they have invested in their e-commerce capabilities during the pandemic, so there is clearly more work to be done to adjust to this new reality.

Testing new approaches (such as social commerce and direct-to-consumer models) should be on the agenda, while investigating people’s changing needs and the importance of different touchpoints in new e-commerce journeys will inform those strategies. Businesses will, therefore, need data strategies that can integrate owned and third-party data to provide faster insights around new buyers and new opportunities.

3. Organisation performance and innovation

Almost two in three leaders don’t feel like they have the right operating model to be competitive.

During the pandemic, just 20% of businesses experienced growth. At least 59% of the companies that achieved growth, or didn’t suffer any losses, pivoted their business model, while more than a quarter invested more in innovation. Recovery will require businesses to make drastic changes to old ways of working and significantly review and invest in organisational performance.

Create a feedback loop with your employees and consumers to ensure your corporate narrative and long-term strategic priorities are still relevant, and to accelerate your learning curve and consistently scale best practices. Siloed organisations that isolate customer experience from sales and marketing need an urgent shakeup to get a holistic view of how to reactivate demand.

A final overarching imperative is to invest in insights. We know that brands in growth understand consumers and navigate accordingly. Relying on assumptions is not the best way to thrive, especially in times of crisis.

Will your brand be brave enough to make the changes required for recovery?

As analysis of Kantar’s BrandZ data shows that brands with great customer experience grow their brand value 10 times more than brands with average CX, it’s a no-brainer why getting customer experience right is essential to your marketing toolkit.

Barbara Cador, Kantar 31 Mar 2020

Hear all about the magnificent seven of CX from Barbara Cador at our upcoming webinar with the Marketing Achievement Awards (MAA), from 11am on 11 March 2021, where she will explain why a focus on your brand experience translates into real returns. Register your seat: https://bit.ly/3khp9F2

About the author

Barbara Cador is the global head of CX+ at Kantar