Why real-time, always-on consumer data is a necessity

The Covid-19 pandemic has laid bare the susceptibility of human psychology and behaviour to rapid alteration. Those businesses in touch with how their

consumers are feeling, thinking, and behaving – through real-time, always-on consumer data – are afforded the necessary insights to foster agility and responsiveness. Both, we believe, are key to corporate sustainability.

The link between valuation and brand strength

Covid-19 had a material effect on listed company valuations. According to KPMG’s report on the impact of the pandemic, the global banking industry saw its valuations (price-to-book ratio) drop from an average of 1.00x at the beginning of 2020, to 0.69x by the end of April 2020.

As economies and consumers slowly return to normality, market-wide valuations have begun to recover. But there's a disparity in the rebound. Tech and pharma wiped out Covid-19 losses and powered higher, while the energy and financial services sectors settled well below pre-crisis levels.

There are industry specific dynamics that explain these divergences. But what’s become clear is that companies with a strong brand, in the eye of the consumer, have seen valuations recover faster.

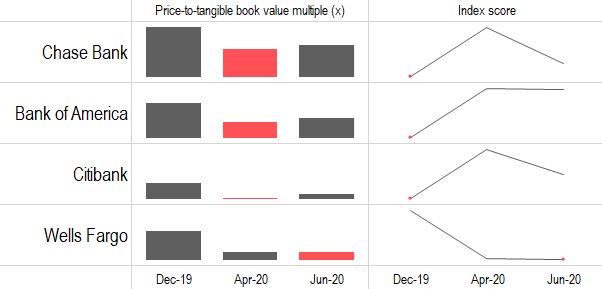

This valuation data is extracted from KPMG’s report on the impact of Covid-19 on banking. The index score (a measure of brand resonance from a consumer perspective, including perceptions of value, quality, reputation, general impression, satisfaction and recommendation) is sourced from YouGov’s daily public perceptions tracking, BrandIndex.

Scaling back on comms? Not the answer

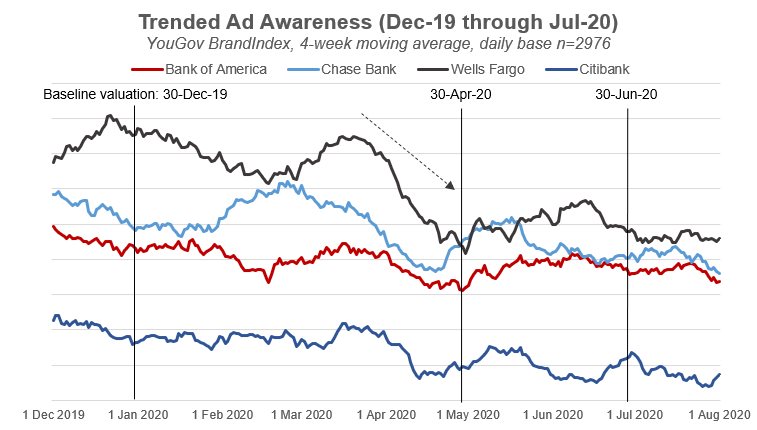

Many businesses had their marketing and advertising budgets slashed when the pandemic began to ravage their revenue. This resulted in decreased awareness, which has a more pernicious knock-on effect, particularly in the financial services sector: a loss of trust.

KLA’s analysis of daily public perceptions data (YouGov BrandIndex) reveals that businesses that chose to scale back on communication during the pandemic – causing their ad awareness metric to drop – are now struggling to regain their pre-crisis equity valuations, compared to peers who maintained or ramped up awareness efforts.

An obvious solution, for those facing budget constraints, is to enhance online communication capability. Put simply, digital’s reach and relative cost-effectiveness make it an attractive alternative.

But while these platforms are effective in shaping customer experience and communicating product and service offerings, the fact remains that building trust and providing reassurance – the bedrock of any successful financial services business – is still best achieved through above-the-line (ATL) campaigns, as evidenced through our extensive consumer touchpoint audit work. And what you choose to communicate is just as important as the chosen channel.

Why you need real-time insights

Okay, so now you know that the way consumers feel about your brand is important. You also know that consistent communication is key to cementing trust and loyalty. But how do you ensure that your messaging resonates with your target market on an ongoing basis?

Brand-building is often considered to be a long-term endeavour where consumer preferences are sticky and slow to change. But this dynamic is under construction. Using digital channels, brands now communicate with their consumers much more frequently across multiple platforms.

With more information about your brand and your competitors’, consumers’ opinions and allegiances have become more fluid. Luckily, the information age has also made it possible for brands to monitor how consumers are feeling about them, in real time.

This knowledge can help businesses to:

- identify new business opportunities and risks

- rationalise product/service offerings

- improve customer experience across various touchpoints

- revamp sub-optimal brand messages

From a marketing and advertising perspective, knowing what your consumer is thinking, and what behaviours might result, can greatly improve your ROI, by ensuring that your content addresses the current concerns of, and resonates with, your target audience.

Finally, because you can gather feedback from consumers almost instantaneously, poorly performing initiatives can be reworked/scrapped before they damage your reputation or waste resources.

What we’re learning closer to home

As we get closer to consumers – by leveraging our access to vast international databases and analytics tools – we’ve come to see the value in understanding how consumer thinking and behaviour is changing daily; helping businesses stay relevant, agile and resilient.

We also see mounting evidence that consumers are responding more to brand activity and communication. Businesses that get their messaging right in the short term – informed by real-time, always-on consumer data – will reap the rewards of better conversion and retention in the long run.

There are already businesses that use real-time consumer-perception monitoring to enhance their marketing and advertising functions. You already know many of them. To compete with the likes of Amazon, Google, and Facebook going forward, the financial services industry would do well to follow this lead when it comes to understanding what their customers want… today, now, immediately.

Get to www.kla.co.za, where we get it.

- Sustainability and ethics - How South Africans see the future in 202522 Oct 15:22

- Family functionality tops South African car buyers' priorities in SA09 Oct 14:22

- South Africans prioritise wellness as generational differences shape health approaches22 Sep 15:43

- Consumer insights consultancy, KLA, reveals the Quarterly Buzz results for Q2 202516 Sep 09:04

- South Africans embrace smarter financial habits in 202511 Sep 16:45