Some interesting findings emerged about the South African market from WE's inaugural Brands in Motion research.

Seventy percent of South African respondents said it was a pleasure dealing with companies in the tech B2B category. The same percentage felt that these companies were at the cutting-edge of innovation and that they could not live without them. In other words, if tech B2B services were taken away, consumers would definitely want those services back.

But when it came to the finance and banking sector, things look a little different. While 63% of South Africans say they can’t live without the services provided by this sector, only 57% would want them back if they were taken away.

One reason for this is because of the massive disruption taking place in this industry in particular. The harsh reality is that consumers don’t necessarily need banks anymore. Alternative finance companies, digital technologies, crowdfunding and the rise of cryptocurrencies that essentially cut out the middleman are providing hassle-free, low-cost options for people to send and receive money and pay for goods and services.

These services are not only providing better experiences, they’re also touching on the rational and emotional drivers of consumers.

Realities and opportunities

So how do South African banks survive this motion? They can start by considering these four realities:

First, banks need to understand that despite all this movement and change, consumers still crave stability; they need brands to be a stabilising force in uncertain times. This presents an opportunity for banks and financial institutions to offer new value to their customers, on par with the new competitors entering the market.

Second, banks need to be cutting edge. Our research found that 52% of South Africans already feel that the industry is at the cutting edge of innovation but if banks really want to rise above the noise, they need to look past their products to use technology to innovate in other areas that will lead to positive brand outcomes.

Third, banks need to strike a balance between delivering highly-functional and beneficial products and services, and taking an active position on issues that provide long-term social value. Consumers increasingly expect brands to take a stand on important issues and these play a massive part in their decision-making. What stands are banks taking on issues that matter most to South Africans? Are they speaking out against corruption and political instability? Are they offering insight into the economy? What are they doing about the massive unbanked market or about financial education in general? Consumers don’t care as much about fancy banking app features as they do about their values and how banks align with these.

Lastly, even if banks tick all the above boxes, some 98% of consumers would not think twice about publicly shaming them if they stepped out of line – no matter how loyal they are. Interestingly, South Africans said they would defend the tech B2B sector to the bitter end. That’s the kind of relationship banks should be nurturing with their customers. If banks want loyalty, they need to build stronger emotional connections with their customers – especially in times of crisis.

Simply surviving is not enough

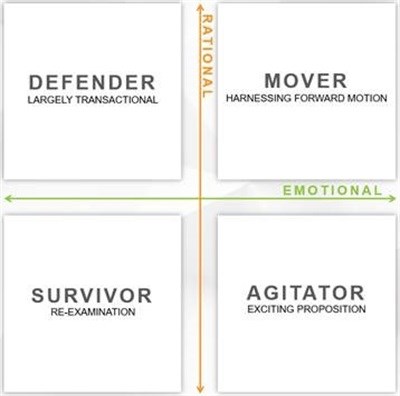

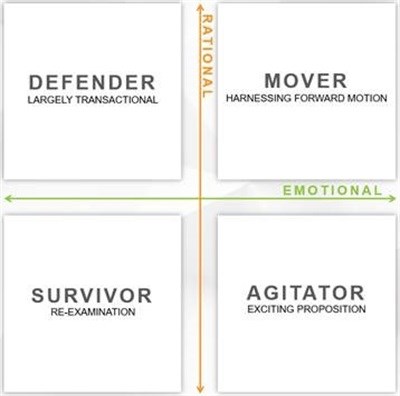

WE scored banks against all these criteria and found that they were merely surviving – and this is not a comfortable place to be. Banks scored low in both emotional and rational drivers and need to do something big if they want to move into the ‘Mover’ or ‘Agitator’ quadrants on the WE Motion Matrix.

Survivors need to move fast if they want to reach people on an emotional and rational level, to move their brands to a leading position in the industry. If not, they could quickly become irrelevant.

They need to work towards becoming movers that harness their forward motion, or agitators who excite and engage their audiences on new levels.

WE Motion Matrix.

Ultimately, all brands and all industries are in constant motion. Depending on the internal and external forces being exerted on brands, they’re either moving forward, moving backwards or spinning in place. Unfortunately, banks are spinning on their axes. All it will take is one swift blow to knock them into irrelevance.

But it’s not too late for banks to take control of their own motion, to excite, engage and connect with their customers. To provide value and to show that they care about what matters most to their customers.

Standing still is not an option. Moving backwards is not an option. The only option is forwards and it starts with truly understanding your customers and what matters most to them in an age of constant change, chaos and motion.