The UCT Unilever report, 'Connecting with Survivors' states that Survivors (defined as people with a household income of less than R6,000 per month) have over R300bn of spending power, according to the National Income Dynamic Survey. Survivor incomes have grown and in 2015 spending on grants increases from R118bn to R145bn.

"The Unilever UCT Institute became interested in studying marketing for the mass market, as experience showed that most marketers have limited information and understanding of this market, which is changing quite rapidly in a number of ways. We noted, for example, that routes to this market were changing and that the informal sector is far bigger and more robust than was thought, largely because most data about this end of the market tends not to record the informal end," says Professor John Simpson from the UCT Unilever Institute.

There is also a 'hidden' income that is generally not declared from Survivor's own businesses, including informal loan income, lobola income, sale of produce or sheep and chickens, employer gifts, ad hoc employment and rental. Examples of these entrepreneurial enterprises include taverns, hair salons, tailoring, building, personal services, appliance repair, agriculture, art & craft, entertainment, educare, recycling, health services, phone shops, and takeaways. South Africa is a mix of developed and developing economies with a strong slant to operating as a developed economy.

The report provides different estimates for the size of the informal economy, StatsSA R120bn, Prof Haroon Bhorat (UCT) R280bn, and Loane Sharp (Adcorp) R680bn. To get an accurate idea of spending power of Survivors, the informal and formal totals need to be added.

Informal shops, spazas earn R50bn

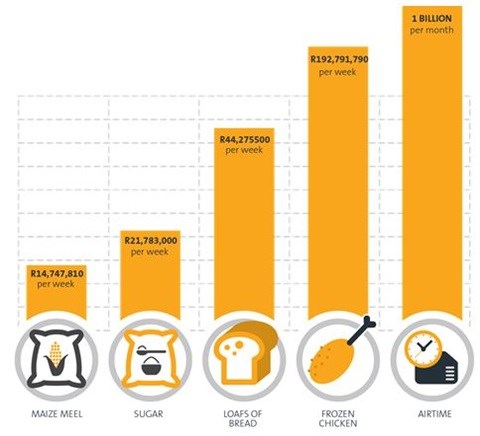

"As a brand owner, marketer or media agency professional you ignore the informal sector at your peril. Informal is the new normal. According to FutureFact 2014, two in ten of Ads24 mass-market title reader's households earn income from informal businesses that goes unreported. So what is the real average monthly income? According to AMPS the amount spent at informal shops and spazas every year is R50bn," says Tania Barzu Portfolio Manager: Trade Marketing and Business strategy.

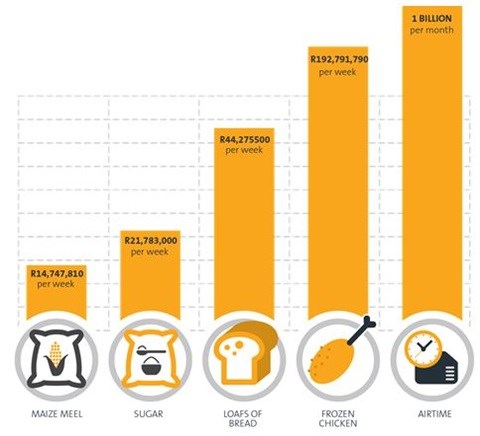

Ads24's mass-market titles, Daily Sun; Son; Ilanga, and their digital properties, have a national reach of 7.3 million people, which is comparable to the entire population of Hong Kong. The readers of these titles spend R32bn each month.

The mass-market titles and local titles are found in the hearts of mass-market communities and have a place in the hearts and minds of the individuals within them. Ask Afrika's Kasi Star Brands survey reveals that 48% of Kasi shoppers use a taxi, 10% have personal or family transport, proximity and route to market are a key component in successful brand strategies. Access to shops that are convenient and close to the consumers' homes creates a good return on investment (ROI) for the Kasi shopper and this equates to value.

Sarina de Beer, MD of Ask Afrika says, "With the ROI paradigm in the township environment, we need to also look further than at what is obvious. Behaviour is always linked to purpose, but usually goes hand in hand with a form of expression; something the community or subculture wants to express about themselves and this is what advertisers need to tap into. I still believe Daily Sun is a very powerful window into the lives and realities of the people they want to sell to. It was amazing to see how all the main themes emerging from the data were also topical discussion points in the Daily Sun."

Mass-market is localised

"The mass market's most unique differentiator when compared with the rest of South Africans is that their lives are very localised, especially if they are urbanised. Movement out is usually to get to and from work," says Prof Simpson.

The cost of transport is significant to this market so they will normally do one monthly bulk shop at a formal retailer and then do their top-up shopping at informal retailers that are close to their homes or en route to their work.

According to the UCT Unilever Institute there are 2500 chain stores in South Africa, 18,500 independent traders and over 80,000 spazas. There seems to be a shift in sales towards the informal market. In addition, there are over 300,000 hawkers countrywide who provide a convenient service, create shopping nodes and control brand messaging by word of mouth.

The Connecting with Survivors report divides retailers up into two segments the formal national chains which consist of supermarkets and wholesalers, and the informal others which include: independent retailers, 'go-getter' retailers (usually foreign family owned, Chinese, Pakistani, or Somali) and 'survivalist' retailers (usually owned by local individuals in the community).

The route to market for brands is changing and brand owners need to take cognisance or they can lose more and more control of the marketing message and distribution of their products. Another threat is that they are replaced by new brands in this dynamic informal environment. The independent sector is changing and marketers who do not recognise the importance of this economy in the mass market are missing the boat.