Source: Clicks

The whitepaper is a comprehensive annual snapshot of the loyalty habits of over 33,000 South African adults with a gross monthly household income of R10,000 or more. For the first time, there is additional insight into the loyalty behaviour of South Africa’s mass market consumer included in the loyalty whitepaper.

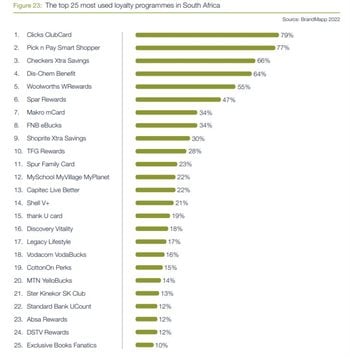

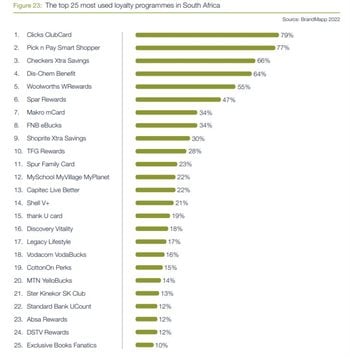

Most-used programmes

Clicks ClubCard has regained its position as the most used loyalty programme in South Africa, for the fourth year since the whitepaper series began in 2015. According to the report, 79% of South African consumers who use loyalty programmes claim to use the Clicks ClubCard programme.

At the recent Leaders in Loyalty Summit organised by Truth, Melanie Van Rooy, head of marketing at Clicks Group stated: “Meaningful and personal customer relationships have become key in the modern retail environment. The war of the wallet and mind space of the consumer is more fiercely contested. This has propelled us to really re-think our loyalty programme and the way that we interact with our customers through traditional relationships.”

Truth & BrandMapp South African Loyalty Whitepaper

click to enlargePick n Pay Smart Shopper has dropped to second place after occupying the top spot last year.

The relatively new loyalty programme from Checkers, Xtra Savings, has gained ground on other retailers in the top 10 and now

occupies third position, ahead of Dis-Chem Benefit, Woolworths WRewards, Spar Rewards and Makro mCard, Shoprite Xtra Savings and TFG Rewards.

Outside of the retail sector, FNB eBucks and Spur Family Card retain their top positions as the most used financial services and QSR/restaurants loyalty programmes, respectively.

In terms of the loyalty programmes that South Africans claim they can’t live without, both Discovery Vitality and Standard Bank UCount are the winning brands in terms of being indispensable to their members.

Average of 9.2 programmes per person

The South African market has been consistent over the past six years in terms of over 70% of South Africans using loyalty programmes.

Amanda Cromhout, CEO of Truth states: “South Africa is a mature loyalty market. We have exceptional loyalty experiences in South Africa and the results in the 2022 Truth & BrandMapp Loyalty Whitepaper confirm this once again.

“We have seen an explosion in the volume of programmes which South Africans use over the past eight years. This has grown from an average of 3.6 programmes per person to 9.2 programmes in 2022.”

Cash continues to remain king

Cashback from points remains the number one loyalty benefit of choice; all ages, income and genders vote for cashback. Interestingly, the BrandMapp study asked consumers if they prefer to save points for a bigger reward or to be instantly rewarded. Customers tend to fall into three groups: those who wish to save points for a bigger reward, those who wish to be instantly rewarded and those who want both.

Surprisingly, consumers still prefer to swipe a loyalty card than identify themselves via apps or other digital means like digital cards.

Shoprite Xtra Savings dominant among lower-income consumers

For the 2022 loyalty whitepaper, there is additional insight into the loyalty behaviour of South Africa’s mass market consumer, based on a parallel loyalty study by MoyaApp, reaching consumers with a household income of R10,000 or less.

Eighty-two percent of mass market consumers are using loyalty programmes and the loyalty programmes strongly influence their choice of shopping and banking brands. Shoprite Xtra Savings is the most used loyalty programme for the lower-income consumer, followed by Pick n Pay Smart Shopper. The most used financial services brand is Capitec Live Better, a relatively new loyalty offering in the South African market.

“The 2022 loyalty whitepaper findings offer great insights for brands looking to become market leaders in loyalty. In today’s competitive environment, staying close to your customers via a loyalty programme is a must and a powerful strategic tool to help you serve your customers better,” concludes Cromhout.