Since early 2020, the Covid-19 pandemic has dramatically stirred up the global and local coffee industries. Increased demand has been witnessed within the coffee industry, largely driven by consumers staying home due to pandemic-related restrictions, but still wanting to enjoy their favourite coffee drinks. This has led to more consumers seeking out at-home alternatives to their favourite coffee orders, as well as brewing advice and equipment, to improve their at-home coffee experience.

Insight Survey’s latest South African Coffee Industry Landscape Report 2021, carefully uncovers the global and local coffee market (including the impact of Covid-19), based on the latest intelligence and research. In particular, it describes the latest global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African coffee industry environment and its future.

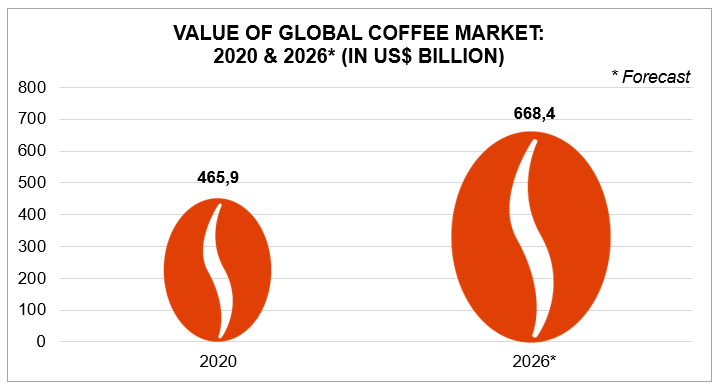

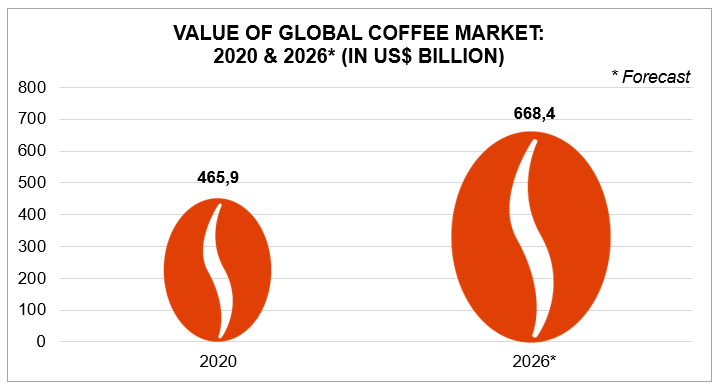

The global coffee market was valued at approximately $465,9bn in 2020. Furthermore, the market is expected to increase at a compound annual growth rate (CAGR) of approximately 6.2%, to reach a value of approximately $668,4bn by 2026, as illustrated in the graph below.

Source: GNS;

graphics by Insight Survey click to enlargeIn South Africa, the local coffee market experienced positive growth, in terms of off-trade retail value RSP at constant 2020 prices, achieving a 2.1% year-on-year growth relative to 2019. This increase is expected to continue, with the market forecast to grow at a CAGR of 2.5% between 2021 and 2025. This growth, both globally and locally, is being driven by several factors, including the increase in at-home coffee consumption.

As a result of the Covid-19 pandemic, consumers, both globally and locally, are looking for ways to improve their at-home coffee experience, as well as continuing to enjoy their favourite coffee drinks, without having to leave their homes. To cater to this demand, multiple global coffee players have introduced at-home versions of their products.

These include out-of-home coffee retailers, such as Costa coffee, Pret A Manger and Starbucks in partnership with Nestlé, which have all expanded their at-home offerings or launched new product ranges for at-home use.

In addition to purchasing at-home versions of their favourite coffee orders, more consumers are looking to elevate their home coffee drinking experience, by experimenting with different at-home products and brewing methods. This is particularly prevalent among South African consumers, who are becoming more educated on home-brewed coffee, as well as having increased access to home-brewing tools. One such example is Bialetti’s recently launched Moka Induction. This product is the first Moka pot that can be used on induction hobs, rather than gas hobs, open flames, or traditional stoves.

Furthermore, more South Africans are making use of coffee subscription boxes, which offer a range of high-quality coffee products that can be delivered straight to consumer’s doors. Certain coffee subscription services also offer additional features, such as instructional videos, access to roaster employees, as well as the opportunity to experiment with new coffees. In addition, many consumers are making use of their time at home to experiment with coffee trends, such as dalgona coffee. This coffee drink can be easily made at home and has become a popular trend on social media, following its appearance on a Korean TV show. It was named dalgona as it looks similar to Korean street toffee.

However, South African consumers are not just making their coffee drinks at home. According to insights released by Uber Eats, the average amount spent on coffee orders per month on the app doubled in April 2020. This was due to more South Africans working remotely and ordering coffee for home delivery. Moreover, the group found latte coffees to be the most popular coffee drink ordered by South Africans, followed by Americanos. The remainder of the top five coffee orders included espressos, frappes and cappuccinos.

For many consumers, staying at home does not mean that they wish to give up the experience of enjoying their favourite coffee drink. Therefore, at-home coffee consumption is set to continue to drive the coffee Industry, both in South Africa and across the globe.

The South African Coffee Industry Landscape Report 2021 (165 pages) provides a dynamic synthesis of industry research, examining the local and global coffee industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – from key global and South African market trends, innovation and technology, drivers and challenges, as well as manufacturer, distributor, retailer and pricing analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (production, consumption, trade, pricing) of the global and South African coffee industry?

- What are the latest global and South African coffee industry trends, innovation and technology, drivers and challenges?

- What are the market value and volume trends in the South African coffee industry (2015-2020) and forecasts (2021-2025), including the impact of Covid-19?

- Who are the key manufacturers, distributors, importers/roasters and retail players in the South African coffee industry?

- What are the prices of popular coffee brands and products (OOH, instant, fresh and ground, beans, capsules and ready-to-drink coffee) across South African retail outlets?

Please note that the 165-page full report is available for purchase for R35,000 (excluding VAT). Alternatively, individual sections can be purchased for R15,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: South African Coffee Industry Landscape Brochure 2021

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke competitive business intelligence research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised competitive intelligence research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.