Whilst the global Covid-19 pandemic is having a devastating global impact, the resulting symptoms such as dry cough, fever and respiratory difficulties has been positive for the cough, cold and flu remedies market. Over the past few months, consumers have engaged in panic buying to be better prepared in case of infection, which has boosted sales and the growth of the cough, cold and flu remedies market.

Insight Survey’s latest SA Cough, Cold and Flu Remedies Industry Landscape Report 2020 uncovers the global and local cough, cold and flu remedies market based on the latest information and research. It describes the relevant global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African cough, cold and flu remedies industry environment, and its future.

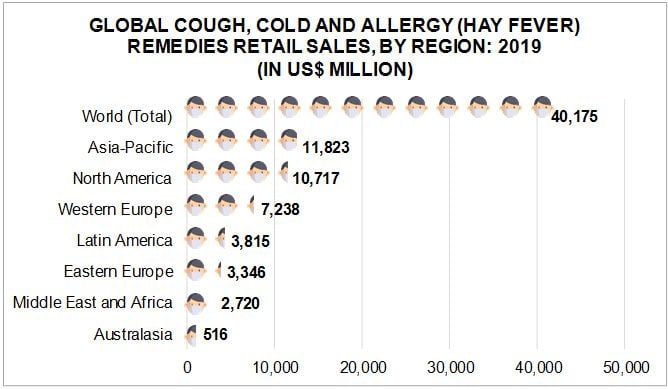

In 2019, the global cough, cold and allergy (hay fever) remedies market reached a total value of approximately US$40.2 billion in terms of retail sales, as illustrated in the graph below. Regionally, Asia-Pacific represented the largest market in the global cough, cold and allergy (hay fever) market, reaching a value of approximately US$11.8 billion in 2019. This was followed by North America and Western Europe, which was valued at approximately US$10.7 billion and US$7.2 billion, respectively.

In South Africa, the cough, cold and flu remedies market increased by 5.2% from 2018 to 2019. Growth in this market has been largely supported by significant growth in the cough remedies category, which experienced a CAGR of 7.5%, between 2014 and 2019.

The annual flu season, as well as the current global coronavirus outbreak, are two of the most significant factors that are predicted to affect the South African market in 2020. The market had been positively impacted by an extended 2018/2019 lasting 21 weeks, the longest in a decade, whilst the 2019/2020 influenza season is predicted to be more severe due to the expected prominence of the Influenza B virus in the coming season. In particular, the Influenza B virus poses a high threat of infection among children.

In addition to the approaching influenza season, the global outbreak of the coronavirus is further driving sales of cough, cold and flu remedies. In South Africa, the rate of coronavirus infections is starting to peak, resulting in significantly increased demand for cough, cold and flu remedies.

Consumers are panic-buying these types of products, in an attempt to prepare for the virus, including over-the-counter (OTC) products. Initial demand for these products was also driven by the ban on the export of 26 pharmaceutical ingredients from India, the world’s largest supplier of generic medicines, with fears that this could result in product shortages.

In response to the increased demand for these products, some manufacturers are increasing their production to keep up with demand. An example of this is Aspen Pharmacare, who are redirecting resources to ensure that there are sufficient quantities of general medications, as well as cough, cold and flu remedies, for consumers to purchase. As an illustration of this phenomenon Aspen Group’s CEO, Stephen Saad, indicated that some daily medicine orders were equivalent to 20% of monthly orders.

Predictions of an extended and severe influenza season, as well as the continued spread of the coronavirus, are key drivers that will boost the growth of the cough, cold and flu remedies over the next 12 months.

The South African Cough, Cold and Flu Remedies Industry Landscape Report 2020 (101 pages) provides a dynamic synthesis of industry research, examining the local and global cough, cold and flu remedies industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to competitor analysis, retailing, to pricing and purchasing trends.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global cough, cold and flu remedies industry?

- What are the key global and South African cough, cold and flu remedies industry trends, innovation and technology, drivers, and challenges?

- What are the market value and volume trends in the SA cough, cold and flu remedies market (2014-2019) and forecasts (2020-2024)?

- Who are the key manufacturers, distributors and retail players in the SA cough, cold and flu remedies industry?

- What are the prices of popular cough, cold and flu remedy brands and products at retail outlets and pharmacies?

Please note that the 101-page report is available for purchase for R27,500.00 (excl. VAT). Alternatively, individual sections can be purchased for R12,500.00 (excl. VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202 or (010) 140- 5756.

For a full brochure please go to: South African Cough, Cold and Flu Remedies Industry Landscape Report 2020.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 13 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.