Malt beer loses ground to market shifts

BMi Research has released its 2014 annual quantification report on malt beer in South Africa, which indicates that with its higher prices, malt beer has had minimal growth against the craft beer and sorghum beer products.

© stockphoto-graf - Fotolia.com

Craft beer, though a small proportion of the total market, has been the major trend in 2013. This has slowed the growth of established malt beer brands, as consumers move towards 'hand-made', exclusive beers. The market has seen minimal growth, which is expected to continue.

Other shifts in the industry have included:

- Off consumption gaining share in 2013 as 'cheap' beers are more readily available for consumers and the increase in the numbers of bottom end foodservice outlets such as shebeens.

- Gauteng has seen a decrease in market share due to economic factors such as rising petrol prices, with the implementation of e-tolls towards the end of 2013 expected to further impact the market in 2014. Distribution has shifted, as is seen in many other beverage industries, into the less affluent provinces such as Limpopo, Mpumalanga and North West Province.

- Major brands still hold the greatest share of the market; however, both players and distributors have noted that these brands are now seen as higher end consumables for they are more expensive than craft beer and the rival product sorghum beer.

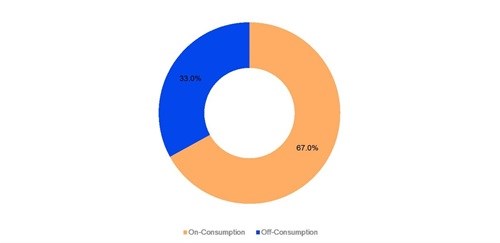

On/off consumption

Though on-consumption is the highest shareholder of malt beer, it has steadily lost market share to off-consumption in recent years, a trend that is expected to continue moving forward.

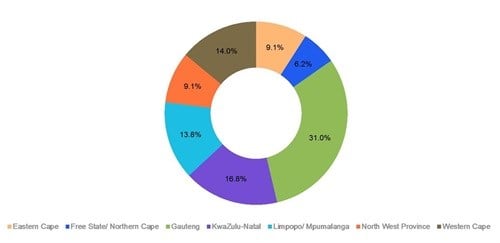

Local regional distribution

Though Gauteng has the highest share of malt beer distribution, the remaining provinces are gaining market share, with the exception of the Eastern Cape, which is a difficult area to access due to its mostly rural demographic nature.

BMi Research specialises in consumer and industrial research in various sectors, including the retail market. For more information, go to www.bmi.co.za.