If you are feeling as if your prepared food, grocery, restaurant and food delivery behaviour has changed over the past few years, you are not alone. Research from Eighty20 shows that while restaurants and coffee shops have battled since Covid and are still ~22% below 2019 revenue (at constant prices), the takeaway and fast-food category recovered quickly after covid and is now ~41% above 2019 levels (at constant prices).

These two categories accounted for R3,9bn and R2,8bn in income respectively for August 2023, according to the latest StatsSA Food and Beverage Statistical Release.

Despite South Africa’s current economic woes, these categories have shown consistent growth over the last three years since Covid. However, this growth has stalled for restaurants over recent months, with July and August showing more than a 4% contraction year-on-year (at constant prices).

Fast food on the other hand has continued to grow in real terms. The fast-food category was a third of the size of the restaurant category pre-Covid, but now it is more than two-thirds – showing just how much consumers’ purchasing behaviour has changed.

The Maps data reflects this overall positive movement in these categories, with the number of people who say they haven’t personally bought food from a fast food/casual dining outlet during the past four weeks dropping from 9% of the adult population to 7.4% from 2022 to 2023.

What does purchasing behaviour look like?

The Eighty20 National Segmentation segments that have contributed to this growth over the past year have mostly been older and wealthier South Africans - Humble Elders (69% growth) and Comfortable Retirees (222% growth).

“The Mass Credit Market and Middle-Class segments have been particularly hit by recent economic pressure and have thus shown the least growth. Growth from lower income segments is reflected by the increase in number of the smaller ‘value’ chain fast food outlets such as Pedro’s and Honchos,” says Andrew Fulton, Director at Eighty20.

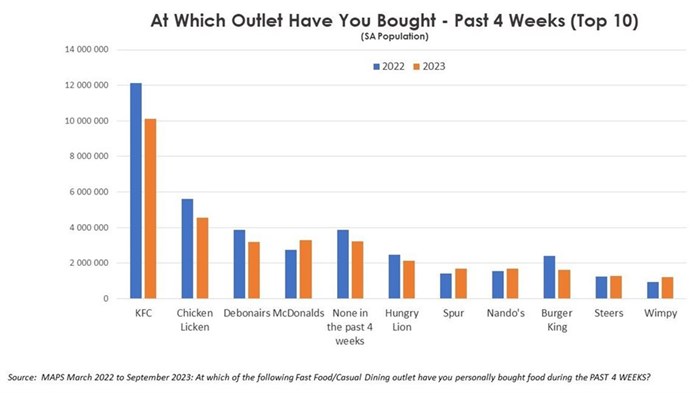

When analysing the top Fast Food and QSR outlets, there are some mixed trends. The top 10 list saw KFC, Chicken Licken, and Debonairs (the top 3) all drop in the past year, while McDonalds, Spur, Nando’s and Wimpy grew.

“Chicken, burgers and pizza make up an estimated two thirds of all fast food spend, with chicken dominating fast food preferences in South Africa. The top 10 list of fast-food outlets, according to Maps 2023 has one pizza restaurant, three burger joints and four chicken eateries,” adds Fulton.

KFC is particularly dominant, topping the list overall and beating out the chicken competition by some distance. In fact, when South African adults are asked the question: “From which one of the following Fast Food/Casual Dining outlets did you last buy food in the past four weeks?” - more than a quarter have been purchased from KFC.

Bucking the trend seen in the StatsSA numbers, it is interesting that casual dining brands like Spur, Wimpy and Nando’s have all fared well compared to some of the more traditional fast-food brands. 2023 saw SpurCorp’s revenue grow by 27.4%, while Steers and Wimpy’s owner Famous Brands grew revenue by 15% for FY2023. Nando’s is privately held, but ranked 6th in Kantar's BrandZ Top 30 Most Valuable South African Brands.

The growth in these casual dining restaurants may be the result of several market changes, including a return towards pre-Covid behaviour and the impact of loadshedding as households look to avoid the challenge of cooking and eating in the dark at home during meal times.

With the rapid increase in online consumer shopping behaviour and new food delivery options such as Checkers Sixty60, UCOOK, Mr D and Uber Eats have transformed the way consumers buy and consume their meals.

“As consumers face tough economic conditions and have to adapt, so do their need states and the occasions that underpin this. Casual dining provides a value offering that allows families to bond over a meal together without breaking the bank,” says Melisha Reddy-Naicker, Research & Insights Manager at Nando’s.

“One hypothesis is that a bucket of fried chicken, or a family trip to Spur is a relatively inexpensive way to bring happiness to a family in tough economic times,” concludes Fulton.