Top stories

More news

Marketing & Media

Chicken Licken bravely debones a rare phobia with their latest campaign

Joe Public 3 days

Last year, most sectors operated online, and many began the move to work from home. This shifted a lot of consumer behaviour habits and media consumption patterns as people lived, shopped, worked and entertained themselves differently. Behaviours that would have taken years to change literally happened overnight.

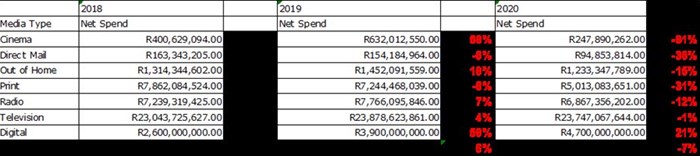

Advertisers had to adjust their marketing strategies constantly to adapt to this new norm, and according to AC Nielsen and IAB, the total adspend for South Africa in 2020 was just over R41bn, based on rate card values. This represents a 7% decline overall due to the pandemic and lockdowns interruptions.

The real decline is actually greater, as these amounts reported do not account for the discounts on rate card rates negotiated. The fall was noted across all ATL (above the line) media channels with the exception of TV that flatlined and digital which posted a significant growth of 21%.

The growth in digital is an indicative shift in most strategies by advertisers aligning their marketing efforts with the shifts in consumer media habits. Where did most of the ad spend in digital go? From table four below you can see that paid search and social made up 75% of the digital spend.

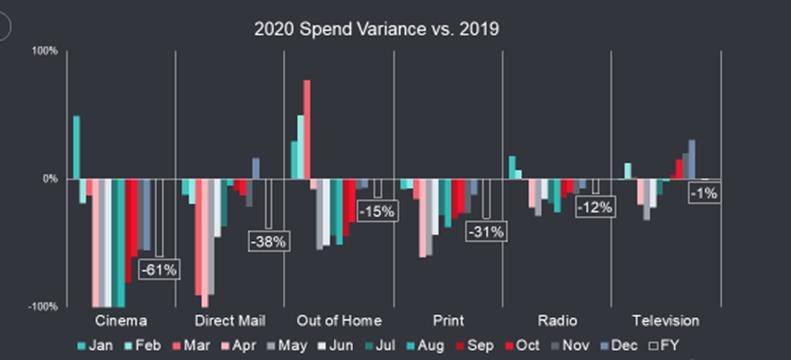

Doing a deep dive going into 2020, ATL compared with 2019 month by month, we can see that in the first two months most media was on track to be better than 2019 but 2020 had other plans.

The first hard lockdown had a significant impact across all media types, all reporting a negative growth in this period. Electronic media started recovering, with TV becoming positive in the fourth quarter only when the country entered Level 1.

The top three categories in 2020 were FMCG with 26% share of spend, retail (22%) and financial services with 18% share of spend.

And how did the top advertisers adjust?

The top advertiser changed with Unilever taking over from Shoprite who had been dominant in previous years although Unilever has been steadily increasing their spend over the past three years. This shows the resilience of the FMCG category during the lockdowns, especially since we were all at home more and sanitizing everything in sight. This result is also not surprising considering the toilet paper shortages in the initial lockdowns.

The question becomes whether we will see this carry over to 2022 and onwards or if we’ll experience more dramatic shifts in advertising media spend patterns across media platforms?