How brands should respond to declining sales

In these distressing times, it is important that we rally around with a sense of community and be the beacons of optimism. We are hopeful that in the very near future Covid-19 will pass and we can, right from now, look forward to the recovery period, which will certainly come.

The best thing we can do, in the short term, is to maintain an audience-first approach; be fast; flexible and agile; to cater to the shift in media consumption and entertainment sources and, most importantly, prepare a smart and solid action plan for when life gets back to normal.

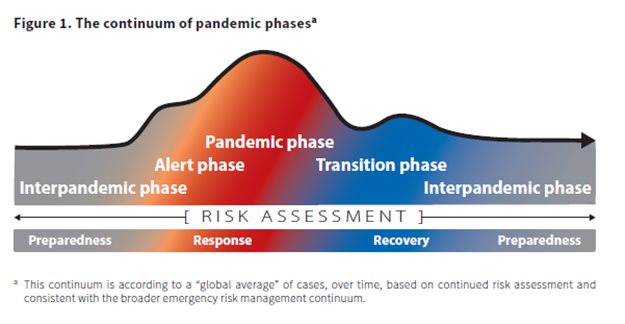

To start with, we need to be very mindful of: the continuum of pandemic phases.

The Figure 1 below shows the World Health Organization’s “Continuum of Pandemic Phases,” displayed as a distribution curve of the hypothetical global average of pandemic cases over time-based on a continued pandemic risk assessment.

We also need to bear in mind that a pandemic will always follow with a recovery phase. Thus, whilst we need to prepare for the short term the long run will remain just as important.

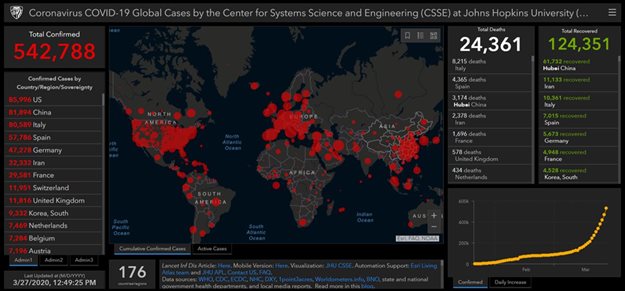

The figure below shows the Covid-19 global cases as at 27 March 2020:

Now, what does Covid-19 mean for brands? Among other things, it means that brands should:

A. Maintain a consumer-first mindset – In this regard, it is important to maintain a sense of optimism with sensitive brand messaging; reflect local consumers sentiment, emotional context and cultural norms with a utility approach; consider the context of media placements, and maintain authenticity and support in messaging and content.

B. Think short term but don’t forget the long-term vision - To ensure this, brands must: Have short-term calibration plan but also keep the long term vision in focus; Responsibly maintain ad spend to win hearts and minds longer-term and SOV; and Continue mass awareness, media activities but with the right message for the climate.

C. Focus on digital and social, but TV is key – For this, brands have to: Ensure that the right content and assets are available (mobile, vertical, short-form, video); Utilise TV, video, streaming and online entertainment advertising opportunities to create connections with bored stay at home consumers; and Ensure all online communication is functioning adequately to respond to consumers in a timely manner and foster community.

D. Maintain digital effectiveness and quality – This, brands have to do by: Maintaining likability; Keeping messaging focused; Keeping branding prominent; Providing new information; Staying relevant and targeted; and Listening, Tracking and measuring sentiment.

E. Prepare for Recovery now by – Capturing the resurgence of demand; Preparing for physical and mental availability; Preparing ready promotions and incentives; and Keeping investments flexible to shift with changing tides.

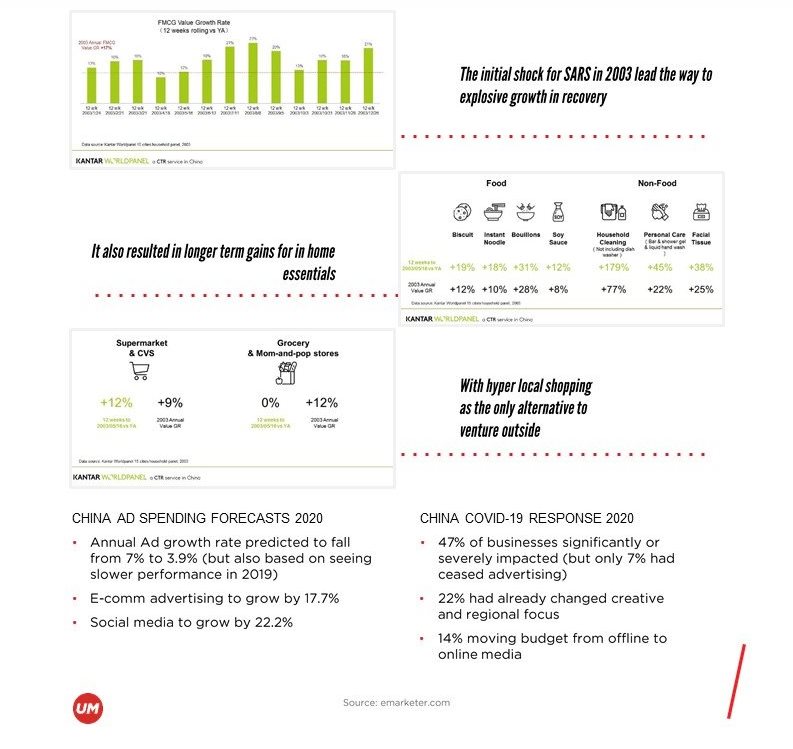

Very importantly, there are lessons from China that need to be carefully considered:

The initial shock for Sars in 2003 leads the way to explosive growth in recovery.

Also, take a look at China ad spending forecasts for 2020 as detailed below:

- Annual ad growth rate predicted to fall from 7% to 3.9% ( but also based on seeing slower performance in 2019)

- E-commerce advertising to grow by 17.7%

- Social media to grow by 22.0%

China Covid-19 response 2020:

- 47% of businesses significantly or severely impacted ( but only 7% had ceased advertising)

- 22% had already changed creative and regional focus

- 14% moving budget from offline to online media

Given all of the above, below are:

Opportunities and challenges for brands

- Anticipate a shift budget towards online, mobile and TV from OOH in the short- term.

- Re-consider short term advertising in any platform that may be affected by lockdown (cinema, OOH, event activation)

- Focus on building brand equity to support long term goals

- Show support in a community focussed grassroots works

- Focus on-demand opportunities – particularly around entertainment

- Continue to build brand equity through the human connections you have. This is not a selling opportunity but an opportunity to be authentic and optimistic.

- Through donations and goodwill news platforms and PR provide the best opportunity to show how your company is supporting the cause

- With internet usage up focus on how you can facilitate or create ties with demand industries – particularly during times of quarantine! Education, fitness, games and more relevant content to beat the inside blues.

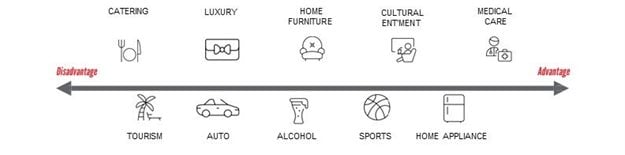

No doubt, there is bound to be an industry impact which dictates that brands should:

- Prepare for a consumer mindset shift on purchasing habits – as the figure below explains:

Key take-outs

- Catering: Innovate with ‘contactless meal taking contactless delivery and safe takeaway; ‘contactless delivery’ and safe takeaway’

- Expect explosive growth in the O2O space

- Tourism: Anticipate travel to peak in July/August and national holidays

- Scale back travel retail and advertising with travel platforms/audiences in the short term

- Reassess travel advertising including airlines, railways and public transport

- Medical: Online medical services will see explosive growth

- Medical e-comm will also surge

- Support reputable medical communities in educating the public

- Home furniture: People will be stimulated to make micro improvements to their home

- Auto: Anticipate a potential post epidemic influx in car buying as people rethink the way they travel

- Anticipate increased in-car advertising opportunities as people prefer to use own transport and keep up to date with news

- Luxury: Prepare for re-shaping of consumer values and mind due to the epidemic on purchasing habits

- Realise opportunities for change in-store experience and consumption environments

- Unlock opportunities for new consumption experience through content and immersive experiences

- Cultural ent: Expect more online experiences on streaming platforms (movie releases)

- Unlock advertising experiences in online virtual shows and exhibition halls

- Expect closures of major music events and theme parks

- Sports: Live streaming fitness and apps will increase

- Take positive actions to use the time to improve health – social platforms/sport brands

- Home appliance: More time at home will stimulate the consumption of cooking appliances and health appliances

Furthermore:

- The big winners will be online streaming services which are ideal for binge viewing

- Gaming will peak online gaming, board games will present more opportunity for brand integration

- ‘Time Killers’ will become imperatives as time spent on video and social platforms surges

- Short video platforms will become important sources of information and entertainment

- Long video platforms will battle for traffic as consumers have more free time

- High-quality content will be imperative to sustain attention

- More schools, universities, exercise classes etc. will go online to cater to the epidemic

- More consumers will turn to online platforms for education in a shift of mind-set following the epidemic

- Major brands plan to live stream activities to continue to stimulate consumer consumption demand and provide entertainment

- New and extended applications of live streaming scenarios will appear such as music events, medical consultations, real estate showings etc.

- We should expect to see podcasting explode as well as advertising opportunities in this channel as consumers find a way to pass the time

- More brand will live stream in order to be able to directly communicate with their consumers in more meaningful, natural and authentic ways

- An influx of office applications will be downloaded and used during the epidemic

- Remote collaborations will become indispensable for business

- Brands that find opportunities to interact with file-sharing/collaboration platforms could tap into a new era of marketing to the remote worker who is looking for pleasant micro distractions throughout their day

Advertising impact:

- Look to reprioritise budgets reserved for key public events, experiential pop-ups and sponsorships

- Unlock opportunities with streaming partners to create engaging content and authentic entertainment experiences

- Continue to assess how your spending could change leading into Q1 as well as Q2 and adapt briefs/plan accordingly

Impact on the advertising market:

Marketing activity may be hit harder than the overall economy for a couple of reasons. Advertising activity relies on a number of business events and trade fairs that are at risk of cancellation; and marketing and advertising spend is partly linked to tent pole events, (mainly sports), that are also at risk. We are now seeing blanket bans on professional sport and events across the globes and locally.

The biggest impact will, of course, come from the Olympic Games postponement till 2021. We should expect marketing and advertising spend to be lower this year, if only because attendance by visitors, sponsors, and advertisers is likely to be below expectations based on a statistical analysis of advertising.

Impact on consumer behaviour and audience supply:

The obvious behavioural impact of a severe outbreak is that people will travel less and stay home more to avoid exposure. This may be exacerbated further if companies begin to recommend or mandate working from home. We can reasonably assume that TV usage of all types will increase if this is the case.

Daytime TV and News viewing is likely to increase as kids and office workers are at home for the next few weeks. In our opinion, the big winners in this scenario will be the streaming services, as a self (or mandated) quarantine situation is ideal for binge viewing, and the influx of new services means there is more content on offer than ever.

We have already seen this sentiment take hold on Wall Street, as analysts seem to share our opinion, and Netflix’s stock price was positively impacted. The big winners will definitely be the streaming services.

Impact on advertising costs:

Increases in viewing and decreased demand from several economic sectors could potentially lead to lower media costs for advertisers, e.g. lower cost on television. We have already some digital publishers seeing a slowdown in ad spend as recently the last week in February, which could be a sign that advertisers are beginning to pull back on media that is easily cancellable.

Lower prices are likely to happen in the short term and may present a good opportunity to increase SOV in this period of uncertainty; however, we will caveat that this may not be a long term trend.

How other brands are dealing with the threat:

- Maintain empathy, kindness and sense of community and optimism actions and messaging

- Discover new opportunities in virtual environments

- Always maintain safety and hygiene and don’t seek to capitalise off the epidemic

Empathy and kindness:

- Microsoft is offering a six-month free trial to the premium version of its Microsoft Teams business, chat/collaboration application, a part of the Office 365 suite. The move comes as fears of the coronavirus outbreak because many businesses to have their employees work from home.

- Pick n Pay opens all its supermarkets and hypermarkets an hour earlier every Wednesday for the elderly customers to shop for their groceries and essentials.

- DSTV has opened access to its premium news channels to customers to help people stay informed about the most up to date news in Nigeria.

- UBA PLC donates N5bn to Africa countries, Lagos and Abuja to get a billion each for relief support during the pandemic.

- Bua Group donates N1bn to Nigeria to support Covid-19 response

- CBN establishes an N50bn intervention fund to support Covid -19 response

About Austin Efienamokwu

Austin Efienamokwu is the CEO of Universal McCann Nigeria, established in Nigeria in 2000 as a strategic media planning and buying agency that leverages Better Science to create Better Art that drives Better Outcomes for its clients.Related

‘Get sky high without a dealer’: Property ad sparks humour vs sensitivity debate 14 Apr 2025 Puma’s biggest global campaign Go Wild: Rooted in history with a new vision of sports 28 Mar 2025 Why Americans care so much about egg prices – and how this issue got so political 18 Mar 2025 Inside Effie’s winning strategies: The hallmarks of an effective campaign 28 Feb 2025 Naked's #GetNakedAnywhere: From OOH billboard campaign to viral TikTok trend 27 Feb 2025 #BehindtheCampaign: AutoTrader Do It Big brand campaign scores big with consumers 23 Jan 2025