A South African's guide to moving to and making it in Malta: Moving markets; changing consumers

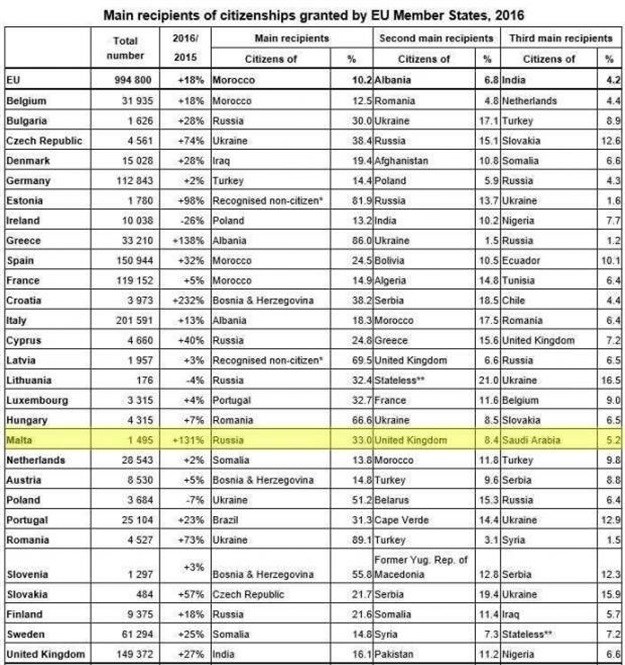

The next biggest movers were Albanians (67,500) with almost 90% of those granted Italian or Greek citizenship. Citizens of India (41,700), Pakistan (32,900), Turkey (32,800), Romania (29,700) and Ukraine (24,000) were also among the largest groups acquiring some of the nearly 1 million EU citizenships granted that year.

At the other end of the scale, the tiny Maltese Islands barely blip on the citizenship radar with only 1,495 people granted their Maltese colours by the government in 2016. Fully a third of all successful applicants were Russians. Expat Brits at 8.4% came in a distant second.

The Russians are coming

Rumours of a Russian oligarch invasion of the archipelago would be overstated: most of the Russian traffic is merely wealthy businesspeople purchasing second passports – and Schengen visa-free access throughout the EU – for themselves and their families. The Russians may rent an apartment to tick a box on the list of citizenship requirements but they don’t appear to live on the island. The second-placed UK contingent are much more likely to be settled in Malta since citizenship becomes an option after five years of residency status.

Although Malta's 1,495 figure for 2016 represented a 131% increase from the 646 citizenships granted in 2015, it was significantly lower than the 3,315 for fellow small EU member state Luxembourg.

Apart from the 29.6% coming from Africa, of the 995,000 people granted citizenship in European Union member states, 20.9% were Asian, 15.2% American and less than 1% from Oceania.

The EU's total of 995,000 citizenships in 2016 was higher than the 841,000 granted in 2015 and 889,000 in 2014.

It might as well be spring

Looking ahead, the European Commission Spring Forecast (ECSF) has projected Malta’s economic growth to remain vigorous over the coming months.

The report observes that labour supply continued to increase thanks to the inflows of foreign workers and the rising participation of women in the labour market. Strong economic momentum should further support employment creation, while the unemployment rate is forecast to remain at 4%.

The increase in the labour supply, it says, has helped to keep wage pressures contained, resulting in stable unit labour costs in 2017.

In the near term, higher expected growth in compensation per employees is projected to result in increases of unit labour costs by respectively 1.5% and 1.6% in 2018 and 2019, above the euro area average.

Malta’s economy, note the ECSF, is among the fastest growing economies in the EU, with record-low unemployment and moderate wage growth. The current account and the budget balances are set to remain in surplus.

Domestic demand is expected to become the main driver of growth in 2018, underpinned by the expansion in private consumption and the recovery in investment.

Strong services sector

Real GDP growth is forecast to average 5.8% for 2018 as a whole, in a context of favourable labour market conditions and high consumer confidence. The strong performance of the services sector, particularly in areas such as tourism, remote gaming and professional services, is expected to sustain the sizeable current account surplus.

In 2019, investment is expected to pick up further, supported by several projects in the health, technology and telecommunication sectors. With domestic demand projected to remain the main driver of growth, and a modest contribution from net exports, real GDP is set to increase by 5.1%.

About Marcus 'The Maltese Falcon' Brewster

marcusbrewster is a brand synonymous with PR excellence in SA. An industry innovator, leader, and inspiration, Brewster affiliated his multi-award winning boutique firm with larger Level 1 BBBEE marketing/comms agency MediaRevolution for scale in 2016 and went on to launch Marcus Brewster International in Europe the following year. Marcus currently lives on - and actively promotes - the Mediterranean island of Malta. For African, S. African and European PR enquiries, contact marcus@marcusbrewster.com or WhatsApp on (+356) 9931 3322